Want to work with all-cash buyers who scoop up multiple properties per year, close fast, and won’t drag you to open houses every Sunday? As long as you’re willing to learn some new skills, then working with real estate investors might just be the best career move you’ll ever make as a realtor. Don’t get me wrong—this is not a get-rich-quick scheme for new agents and it certainly isn’t for everyone.

Building the skills you’ll need to regularly pinpoint undervalued, off-market properties, advise investors, and close sometimes tricky deals won’t be easy. However, if you have a passion for investing, a solid work ethic, and a thick skin, you can easily close 50 to 100 deals a year working with investors—regardless of the market. I’ll walk you through the nine skills you’ll need to hone to start working with investors in 2022.

1. Be an Expert in Your Market

When it comes to attracting real estate investors, you need to know a lot more than just days on market and year-over-year appreciation in the area. You must become a bona fide expert in your local market and sub-markets.

Before you drill down into your local market, you need to understand the 30,000-foot view of the industry. Start by reviewing your local housing statistics and economic policy news to stay up to date so you can better inform your clients of what’s going on.

You should also know about upcoming development projects, zoning ordinance changes, and amenities and attractions in the area. Familiarize yourself with the area’s major employers, local schools, newest shopping and dining areas, and public transportation options.

Sub-markets are smaller areas within your local market that can include the next neighborhood that is likely to pop for investors by researching the neighborhoods in your market that allow short-term rentals and have the highest rent-to-value ratio.

2. Know a Good Deal When You See One

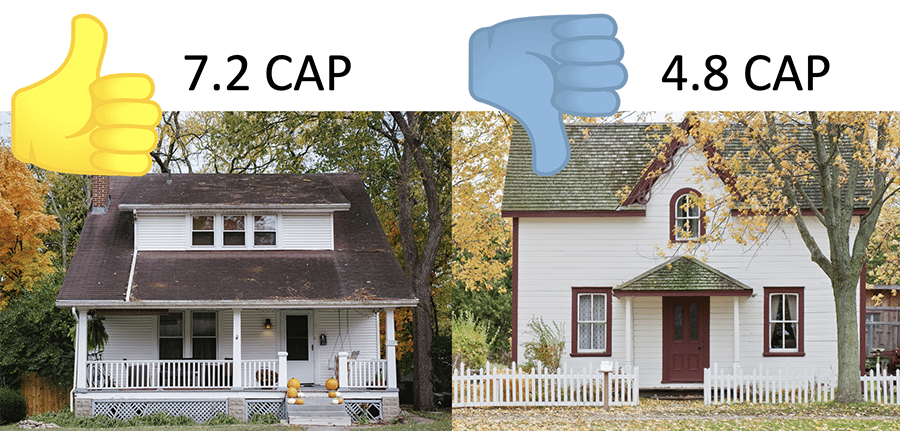

In addition to local market knowledge, real estate investors want an agent who knows a deal when they see one. Nothing is more frustrating to a real estate investor than an agent who sends them a deal or property that doesn’t make any sense. It’s a waste of their time and yours—and a sure way to get yourself blacklisted from any investor’s list of preferred agents.

So, before sending potential opportunities to an investor, take the time to do some basic research on the property. For example, an experienced buy-and-hold investor will expect you to estimate the cash flow and cash-on-cash return of the deal before presenting it to them.

To do this successfully, you will need a deeper understanding of the three basic types of real estate investing and how to evaluate deals in each category: buy and hold, fix and flip, and speculation. If you want to get started learning how to evaluate deals, check out my articles on analyzing cash flow properties and fix-and-flip properties below:

How to Analyze Cash Flow Real Estate Investments + Attract Investor Clients

3. Learn How to Be a Trusted Adviser

If you are going to become the “go-to” agent for investors, then you need to give them guidance and be prepared to help them avoid common mistakes. There are three common mistakes investors make, especially when they are new.

Overpaying for Properties

Real estate investing is exciting and it is easy for investors to allow their enthusiasm or competitiveness to outweigh their logic. This is especially true when they are competing for a deal in a multiple offer situation. In my 27-year career, I have seen multiple investors overpay for properties just so they can say they WON!

There is a saying in real estate investing, “The money is made when a property is bought—not when it is sold!” This is because it is easy to make money when a property is purchased undervalue, but it is nearly impossible to turn a bad purchase into a good investment.

You can help your investors to not get swept up in the excitement by teaching them to set their maximum offer price prior to making an offer and getting into a bidding war.

Underestimating the Repairs

By nature, most investors have a strong self-confidence. They probably wouldn’t be investors if they didn’t. However, their confidence can cause them to overlook details, and underestimate the cost of repairs and the time it will take to complete the job.

You can guide an investor to avoid the mistake of underestimating their efforts and resources by using my Fix & Flip Property Evaluation Process. It was specifically designed to help you and your investor review a property without missing any detail.

Overpricing the Property

Many novice investors have a tendency to want to raise the after-repair value (ARV) after they close on the property or as they are making repairs. When they do this, they can price the home outside the market—and we know an overpriced property loses the initial interest of buyers and can easily become stale on the market. Then after a few weeks, price adjustments are made and eventually an offer is received that is far below what the property would have sold for had it been priced correctly initially.

We know better. Don’t make this mistake, and help your investors by accurately estimating the ARV and advise them to stick to it.

The next thing you need to do to get started attracting investors is to learn how to find undervalued off-market opportunities. Good thing we’re covering that next.

4. Know How to Find Undervalued, Off-market Properties

Experienced real estate investors are looking to buy properties that are below market and want an agent who can find them undervalued deals that aren’t already on the MLS or Zillow.

Let’s be honest here—even if there is a property on the MLS that is 20% below market, if the listing agent is doing their job correctly, they will collect multiple offers and drive the price right back up to, or beyond, the fair market value.

So the secret to finding undervalued properties for your investors is to learn how to search for off-market properties like preforeclosures, bankruptcy, and estate and vacant homes.

If you want to get started learning today, check out my article on my nine proven strategies to find hidden listing inventory: 9 Proven Strategies to Find Hidden Listing Inventory.

Once you find your investor an off-market property, it will be time to get your hands dirty.

5. Be Willing to Get Your Hands Dirty

Real estate investing is definitely not for the squeamish. You have to be willing to (sometimes literally) get your hands dirty. Ask any investor and they will tell you the same thing; “Trash Is Cash!”

Real estate investors take dirty and rundown properties that nobody else wants, and turn them into sparkling gems and make big profits doing it! So needless to say, when working with most real estate investors, you’re going to need to get a little dirty.

You may need to preview hoarder houses and even properties with mold and fire damage, and at times you may find yourself on your hands and knees in a spider web infested crawlspace checking for lead pipes or looking for the cause of the sagging kitchen floor. Ask me how I know …

So, if you’re serious about working with investors, keep the Louis Vuitton’s at home and break out the Timberlands. It can be dirty work.

6. Be a Referral Resource

More than any other type of client, real estate investors need their agent to be a resource for everything from Hard Money Lenders to plumbers.

Over the years, I have worked with real estate investors from just a few blocks away to as far away as China. Unlike 20 years ago, today investors who need your services will come from all over the country and maybe the world. They will all need your contacts and resources in order to find properties, get them ready to rent or sell, and maintain them.

Get started by creating your list of your preferred contractors, attorneys, accountants, and so on, and be ready to share it with them. They will be happy to get your referrals.

7. Learn to Negotiate Like a Boss

A real estate agent should have strong negotiating skills regardless of what types of clients they work with, but it’s especially important with investors. An investor isn’t going to live in the property; it’s strictly a business and a source of income, so they want to get the best possible deal.

You should be able to assist in getting the best possible deal on buying a property or selling a property for the highest price in the fastest amount of time. Make sure you aren’t too shy to push through tough negotiations. You may need to send multiple offers on different properties—some may be “low-ball” offers and you have to be OK with that. It takes a thick skin to work with real estate investors.

18 Top Real Estate Negotiation Strategies From the Pros

8. Invest in Real Estate Yourself (or Be Willing To)

As a real estate investor and agent, I often notice that the agents who don’t understand what a good deal is are also the same agents who don’t invest themselves. That’s because it’s easy to tell someone else to put their time and money into a deal when you’ve never risked any of your own money before!

Early into my career, I was working with an investor couple, and I had found them a new home neighborhood where they could buy a home for $150,000 and rent it for $1,500 a month (a no-brainer buy-and-hold deal).

I told them that this was a great opportunity and they shouldn’t pass it up. They replied, “If it’s such a good deal, why don’t you buy one too?” I thought for a minute and replied, “You’re right. I will!” and I purchased the home directly across the street from them.

If you are serious about working with investors, you must be willing to put your money where your mouth is and invest in real estate too. If you don’t have the credit or cash to buy a property yourself, you can offer to contribute your commission to the deal in exchange for a percentage of ownership.

9. Learn to Speak Like a Real Estate Investor

An experienced real estate investor is looking for a knowledgeable agent with whom they can share investment strategies, and they will quickly dismiss any agent if they can’t speak like an investor.

If a question like “What’s the IRR?” gives you pause, it may be time to freshen up on your investor vocabulary. If this is the case for you, then sharpen your skills by reading up on your investing terms.

Bottom Line

Real estate investors can be an outstanding clientele for any real estate agent, but many real estate investors get turned off by agents who don’t know anything about investing.

Therefore, if you truly want to grow your sales with investors, you must “invest” in yourself by learning more about real estate investing.