If you’re just getting started as an investor or you’re an agent who wants to maximize profits for buyers, you’ll need a solid investment strategy. The BRRRR method is exactly that: a well-defined, tried-and-true investment strategy that offers the best opportunity to build passive income through real estate.

In this article, I’ll walk you through step-by-step instructions to use the BRRRR method to maximize profits for investors.

My Qualifications

Although I am not a financial adviser, I have built and manage a sizable, profitable investment portfolio across the Southeastern United States, with expertise in benchmark markets. However, please remember that every real estate investment comes with risk, and these are just my opinions on BRRRR. You can learn more about my qualifications on LinkedIn.

What Is the BRRRR Method?

“BRRRR” is the acronym for “Buy, Repair, Rent, Refinance, and Repeat.” The BRRRR method allows investors to build equity after purchasing, renovating, and then cash-out refinancing a property. This process can then be repeated, building significant equity and a large investment portfolio.

Why the BRRRR Method Is an Excellent Investment Strategy

BRRRR investing enables you to build a portfolio without committing significant amounts of money over an extended period. For example, if you wanted to buy five rental homes in the past, you would have required a down payment and a long-term mortgage on each. Using this technique, you can still build a portfolio of five rental properties, but it will cost you much less money than a conventional investment.

Because this approach makes use of a cash-out refinancing after the property has been renovated and leased, you may use the proceeds to reinvest in another property while still enjoying the advantages of a long-term mortgage with little to no money spent. In addition, since you own rental property, you may now take advantage of several tax breaks.

The BRRRR method, if done correctly, can grow your net worth, generate passive income via rental revenue, and eventually lead to financial independence by enabling you to own rental real estate in a unique and continuous way.

In my opinion, the benefits of the BRRRR method outweigh the risks. Here are some of the benefits of using the BRRRR strategy to invest in real estate:

1. Return on Investment Potential

One of the significant advantages of BRRRR is the prospect of a substantial return on investment. When done correctly, investors may buy a distressed home for a minimal financial outlay, renovate it, rent it out for a profit, and repeat the process with other properties.

2. BRRRR Allows Investors to Build Equity

The equity that is built up throughout the rehabilitation phase should also be considered. Many investors who pursue a passive income approach are just trying to generate cash flow from a property worth the money they paid for it. BRRRR allows you to build equity as well.

3. Renovated Properties Attract More Qualified Renters

If a home has been professionally rehabbed to satisfy consumer expectations in a particular market, it will almost certainly attract excellent tenants. Tenants prepared to pay top dollar for their rental property in return for specific features and services are more likely to maintain it well and save money. Improved cash flow is often a result of better renters.

4. It Allows Investors to Build Equity & Scale Their Portfolios Quickly

Once you’ve found your BRRRR stride, you can take advantage of economies of scale by using the method on other properties. This allows you to reduce your total expenses by lowering your average price per property and distributing out your risk by owning and managing several rental properties simultaneously.

How to Use the BRRRR Method to Build Passive Income in Real Estate

Let’s take a closer look at each stage of the BRRRR method for individuals looking to develop a large investment real estate portfolio.

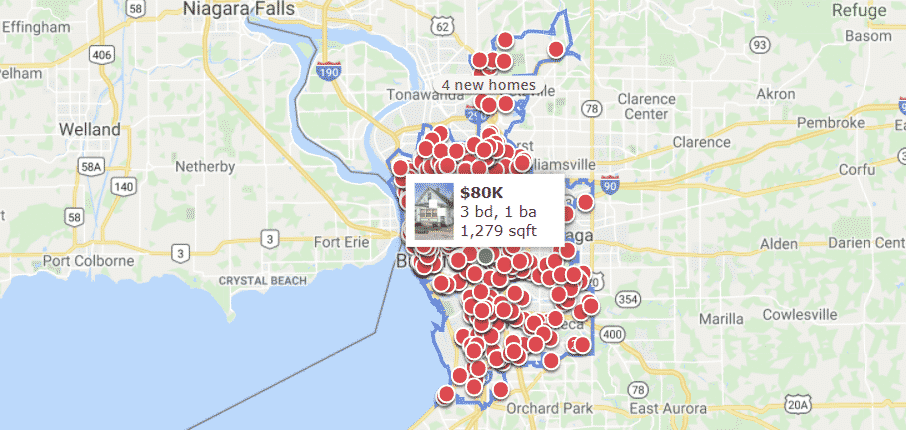

1. Purchase an Undervalued Property

Searching for discounted homes is a vital stage in any smart investment, but it’s particularly crucial when using the BRRRR approach. Here’s why:

First, since these properties are undervalued, you may increase their worth with low-cost improvements. The more you can increase the home’s value, the more equity you’ll have to pay out at step 4: the cash-out refinancing. Second, you look for discounted homes since, unless you have a lot of cash on hand, you’ll need a hard money loan to fund this purchase.

What Is a Hard Money Loan?

A hard money loan is obtained from a private, non-bank lender, and the application procedure differs significantly from that of a bank loan. When you apply for a loan from a bank, your creditworthiness will be the most important element in their choice; with a hard money loan, the property serves as security.

That implies the bank will only consider the property’s investment worth. You’ll receive your loan if it’s a solid investment. As a result, you’ll have to create a compelling argument for yourself.

The interest rate on a hard money loan may be as high as 15%, with a range of 7.5% to 15%. These loans also have a lower loan-to-value (LTV) ratio and a shorter payback period than traditional loans—typically one to three years.

How to Choose a Hard Money Lender

Hard money loans are short-term loans that are used mainly by BRRRR investors and home flippers. In fact, BRRRR’s first two stages are almost identical to the house-flipper formula, without the “flip.” With that in mind, adopting the Rule of 70%, a house-flipping standard, is a smart method to ensure you’re looking at a decent investment.

The Best Hard Money Lenders in 2022 (Interest Rates, LTV, Fees & More)

The Rule of 70%

You shouldn’t spend more than 70% of a property’s after-repair value (ARV), minus repair expenses, according to the Rule of 70%. In practical terms, this implies that if you’re looking at a $400,000 investment property that requires $80,000 in renovations, you shouldn’t spend more than $200,000 for it.

Although this isn’t a hard and fast rule, it does make financial sense. In the example above, after spending $80,000 on repairs, you’ll still have $120,000 in the bank to cover cost overruns, market changes, and other unexpected issues.

What to Look for in a Potential Property

Because renting out the home is the ultimate goal, you should assess the property as a rental throughout the initial purchasing phase. According to the BRRRR approach, a property in a strong, active rental market is preferable to one that is somewhat undervalued but less appealing to renters.

Consider a condo or apartment near a university, which will always be in demand, vs a suburban home in a cul-de-sac, which may have greater raw value but is in a market that is more oriented toward buyers.

When looking at homes, look at vacancy rates and thoroughly check your renters. When making estimates, don’t forget to include property management costs, which often amount to about 10% of rentals collected.

2. Renovate the Property

The next step in the BRRR method is to renovate the home to make it attractive to tenants. You’ll have a decent sense of how much you can afford to spend on repairs after you’ve purchased your home, as well as what particular repairs you’ll need. Once you do, you’ll have three problems to solve:

Finding a Trustworthy Contractor

First, you’ll need to locate a contractor who can properly do the repairs while staying within your budget. That may be more difficult than it seems. You’ll have discovered contractors you can trust by the time you’re rehabilitating your fourth, fifth, or tenth property. However, it may be difficult at first.

The best way to find trustworthy contractors is to ask other investors. If you don’t know any personally, start networking on real estate investing forums like Bigger Pockets. If you’re an agent, talk to your managing broker, or reach out to your association.

Staying on Schedule & on Budget

Second, owning a home costs money every day. Utilities, property taxes, and even loan payments are included in these carrying expenses. Even if your repairs are within budget, if they take longer than expected, you may incur additional costs.

Deciding Which Renovations Will Have the Best ROI

While there have been studies that show which renovations have the best return on investment (ROI) for resale, remember that your renovations will also need to attract tenants. That might mean installing a washer and dryer, improving parking access, or other renovations that otherwise might be left to a new buyer’s personal preference.

To learn what tenants in your area want out of a rental property, research amenities on rental websites like Craigslist, Zillow, or Apartments.com. For example, in college towns, you might find that properties with multiple smaller bedrooms will rent for more than properties with a primary suite.

3. Rent Out the Property

This is the moment at which you would sell your home if you were a house flipper. However, now that you’ve used the BRRRR method, it’s time to convert your property into a cash-generating asset by finding tenants and renting it out.

You will have to move relatively quickly here because, at this point, your expenses will likely be chewing a hole in your wallet. Hiring a real estate agent or property management company to rent your property generally offers a decent ROI for most investors.

Just make sure to choose an agent or property manager who takes marketing seriously—for example, spending $100 or so on professional listing photos can get more people through the door and might get you higher rents and better tenants.

4. Refinance the Property

This is when the BRRRR method proves its worth. You may do a cash-out refinancing after your property has been refurbished and leased, which essentially turns the equity in your house into cash.

Cash-out refinances may help you save money, but they also offer a number of additional benefits. A cash-out refinancing will have a lower interest rate than a home equity loan or a home equity line of credit (HELOC), let alone another hard money loan. You may also deduct interest from your taxes.

If you want to build a real estate investment portfolio, you may choose to pay off your original loan and use the funds for the next stage in the BRRRR method with cash-out refinancing.

5. Do It All Over Again

The money from the previous stage would be ideal for a down payment on a new home. This time, you’ll have more expertise, a growing network of contractors, and a cash-generating rental property under your belt. You might even use the BRRRR method to create a large rental portfolio. With careful preparation, the sky’s the limit.

However, it’s not simple; if it were, everyone would own many rental homes. BRRRR requires meticulous study and preparation. The first step, the purchase, is much more important than the others. But if you get it correctly, the rest of the jigsaw will fit together nicely.

Finally, the BRRRR technique is the only real estate investing plan that can take you from no money down on your first investment to a profitable portfolio of cash-generating rentals in under 10 years. The sooner you begin, the sooner you will be able to achieve your financial goals.

Bottom Line

The BRRRR method is an excellent real estate investing strategy that can help investors build equity and scale their investment portfolios quickly. However, it takes a lot of time, research, and effort to do it successfully.

Have a question about real estate investing? Get an answer in our Facebook Mastermind Group.

Add comment