The number one rule for making money at fixing and flipping homes is to not overpay in the first place—which is not as easy as it sounds. Both new and experienced investors often overpay for their fix-and-flip homes, but you don’t have to!

In this article, I’ll share with you the most common reasons investors overpay for fix-and-flip investment properties and help you calculate the property risk score using my proven fix and flip risk assessment worksheet.

5 Common Fix & Flip Mistakes That Even Experienced Investors Make

Armed with Carlton Sheets’ investment worksheets at 19 years old, I evaluated my first investment property. Since that day, I have evaluated thousands of homes to determine the right offer price.

While there are many reasons even seasoned investors pay too much for a property, there are five common mistakes that you can easily avoid—if you know what you’re doing. I’ll help guide you, so you don’t find yourself underwater on your next fix and flip.

1. Letting Emotion Guide Your Offer

Enthusiasm for doing a deal is great for motivation. Still, it can override your rational thinking and prevent you from seeing a property for what it is, causing you to overlook critical repairs and ultimately overpay for the property.

Before getting out of your car to evaluate the property, take three deep breaths to slow your heart rate and calm your mind for the important task ahead.

2. Offering Sight Unseen

You may be busy, you may know the area, or maybe you’re just lazy. Either way, it’s never a good idea to make an offer sight unseen. Sure, I have done it—and I have paid the price. Literally!

It is often better to pass up a good deal than risk paying too much for a property that you will never profit from—or worse, one that’ll cause you to lose money. Take the time to see each property before making your offer.

3. Overestimating Your Abilities

Show me an overconfident investor, and I’ll show you someone who’s about to make a huge mistake! The secret to remaining a real estate investor is surviving your mistakes and the unpredictable market shifts. Overestimating your abilities can cause you to take bigger risks and increase the chances that your investment career won’t survive a shift in the market.

A little fear is actually a good thing that will keep you humble and able to outlast the “all-in” real estate investors.

4. Overlooking Other Factors

The issues that can turn a good flip into a nightmare are not limited to just the physical condition of the property. Other factors that are often overlooked are zoning restrictions, homeowners associations (HOAs), as well as property and sales tax.

Once you have evaluated the physical condition of the property, take a few hours to investigate these items to ensure your budget can absorb additional expenses.

5. Underestimating the Time a Project Will Take

Paint and carpet … one week, remodel the kitchen and bathroom … one month, vault the ceiling and put on an addition … six months! It is easy to have big dreams for the property, but everything you’re dreaming of adds to the timeline. Especially when the remodel requires Zoning and Permit department approvals.

Be realistic about the time it will take to repair a property and give yourself an extra buffer in case of delays caused by things outside of your control, like government approvals, weather, and contractors.

Time is money, and everything you add to your budget needs to factor into your final offer price. Since you can’t simply sell the property for any price you want, the greater the costs to repair and hold the property, the lower you can feasibly pay for the property.

To help keep me and my coaching clients from overpaying, I created the Fix-and-Flip Property Risk Worksheet.

My Fix & Flip Property Risk Assessment Worksheet

I designed the Fix-and-Flip Property Risk Worksheet to help you stay focused on any items you need to address. Once you complete your property assessment, you can use the worksheet to help you generate the right offer price to ensure you have profit left after making the necessary repairs and the property is sold.

How to Use My Fix & Flip Property Risk Worksheet

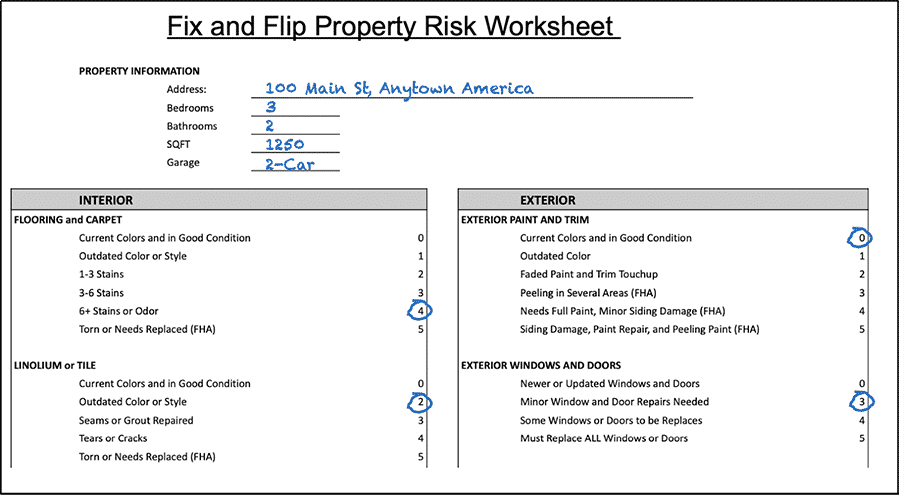

Unlike typical home shopping, where you’re looking at the attractive features of a home when you buy a fix and flip, you want to identify all the items that will cost you big money to repair when you remodel and sell it.

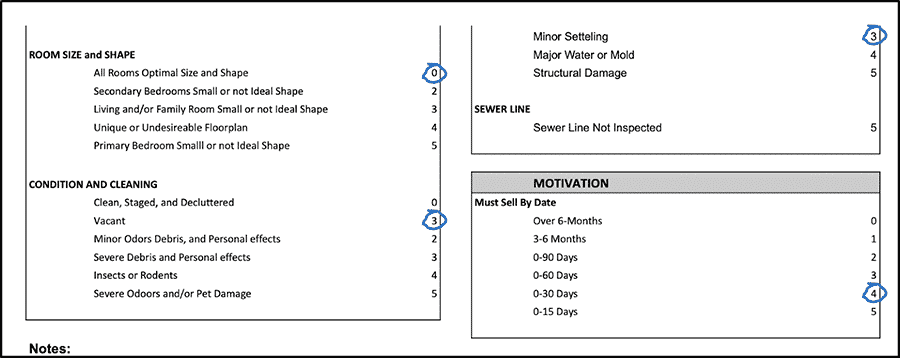

Using the worksheet, you will walk through the property room by room. Follow my Property Evaluation Process to make sure you don’t rush or overlook any little detail. You will give each item on the worksheet a score. The lower the score, the less work you’ll need to do to the property. Be sure to take good notes and photos as a reminder.

Then when finished walking the property, go back to your office and do additional research on the other factors that can positively or negatively affect the property, like the HOA, taxes, and zoning.

Once your research is complete, you will use the worksheet to determine the Property’s Risk Score and decide your offer price range.

The Best Hard Money Lenders in 2022 (Interest Rates, LTV, Fees & More)

The Property Risk Score

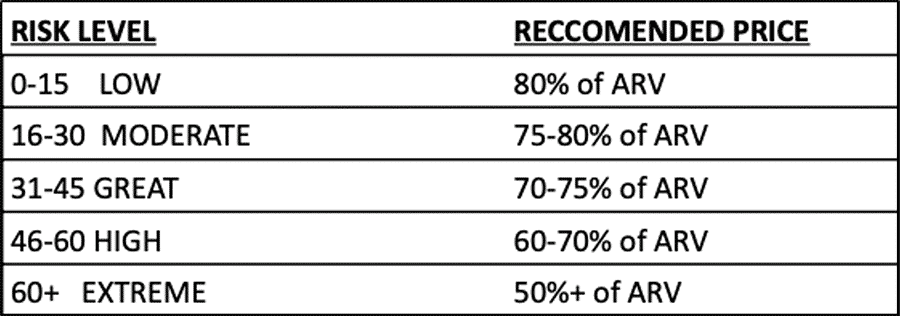

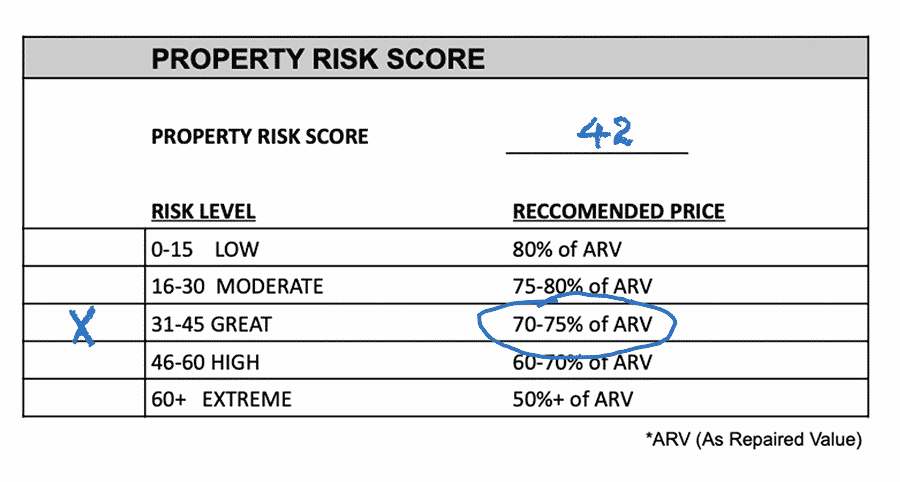

You’ll give the property a Risk Score to help you evaluate your risk and determine your final sales price. The higher the score, the greater your risk. A property that needs minimal repairs may score between 0 and 15 and is considered low risk. A foreclosed property offered for sale in as-is condition may score 45 to 50 would be regarded as a high-risk property.

The higher the risk score, the greater your risk involved, and the less you’ll want to offer for the property. How to calculate the risk score will be explained in detail later.

How to Evaluate Fix & Flip Houses Like a Pro (+ Risk Worksheet)

The Seller’s Motivation & Offer Price

While the property’s condition is important, the seller’s motivation and urgency to sell are often the most significant factors to consider when determining the offer price.

For example, a friend once contacted me regarding a family member urgently wanting to sell their home because their foreclosure sale date was seven days away!

With a looming deadline, I had to inspect the property, arrange for financing, and clear title in less than a week! The seller’s urgency meant additional risk for me, and I adjusted my offer price accordingly. The property might have sold for $300,000 if the seller had the time to market it in the MLS. I paid the discounted price of $230,000 to assume the risk—buying it quickly and helping the seller avoid foreclosure.

However, before you make an offer, you must first forecast the property’s likely selling price range after all the repairs are completed, and the property is expertly marketed. This price is called the After Repair Value, or ARV.

Determining the ARV (After Repair Value)

Look in the MLS for recent sales of similar properties that have been sold in the past 90 days. Have any of them been completely remodeled? If so, this may be a good range for your ARV.

If there aren’t any recent sales of remodeled homes in the area, you can adjust for the remodel by using homes in average condition and adding a premium for the remodel. In many markets, completely remodeled homes with new kitchens, baths, and mechanicals sell for up to 20% more than homes in average condition.

Once you have determined the ARV, you can use the Fix-and-Flip Property Risk Worksheet to help determine your offer price.

Determine Your Offer Price

Now that you have evaluated the property’s condition, factored in the seller’s urgency, and decided on the property’s ARV, we can assess the Property’s Risk Score and pinpoint the right offer price.

Calculate the Property Risk Score

Using the Fix-and-Flip Property Risk Worksheet, total the number from each category and write the number on the Property Risk Score line.

- Check the box that is associated with that number range.

- Look to the right to see what the offer price range should be. For example, if the ARV of the property is $450,000 and the Property Risk Score is 42, then your offer price range should be between $315,000 and $337,500 ($450,000 x .70 and .75 = $315,000 and $337,500).

Once I have found the appropriate price range, I can feel confident about what I am offering and know when to walk away when the asking price is too high. This approach is how you prevent yourself from overpaying and finding yourself upside down in a fix and flip.

Bottom Line

Flipping homes is exciting. It’s easy to get caught up in the romantic idea of buying an ugly duckling and making it a beautiful swan, but don’t let the dream cloud your judgment, leading you to overpay and ruin any possibility of future profits.

Follow these guidelines and use my fix and flip risk assessment worksheet to help you avoid the common mistakes many investors make, including overpaying for their fix and flips.

Add comment