A comparative market analysis (CMA) is a process real estate professionals use to determine the market value of a property by comparing it to similar properties that have recently sold, as well as to those currently listed for sale. A CMA is a crucial tool for listing agents as they determine a price for new homes for sale. It’s also a tool for buyer’s agents who are advising their clients to make competitive offers.

Conducting accurate, consistent CMAs isn’t easy. Most agents aren’t taught this skill in their prelicense real estate classes, so many enter the business without this vital expertise. In this article, we’ll walk through the entire process of creating bulletproof CMAs every time, and give you a free CMA presentation template to share your findings with clients.

Before We Get Started, Did You Know That CMAs Will Get You Listings?

It’s true. There’s nothing that demonstrates your knowledge, expertise, and action better than an accurate, well-presented CMA.

You can use a CMA to seal the deal with a prospective client, as well as use a tool like Elevate’s CMA Wizard to kick-start the conversation with leads. Here’s what we said about this tool in our deep-dive review + video walkthrough of Elevate:

“CMAs are a major time-suck for a lot of Realtors. Elevate’s CMA Tool streamlines the process for you. We could easily see someone who is running a real estate farming campaign using it to create multiple CMAs for entire neighborhoods and integrating them into email marketing campaigns.”

Click below to see how Elevate can kick-start your CMA process and level-up your CRM experience.

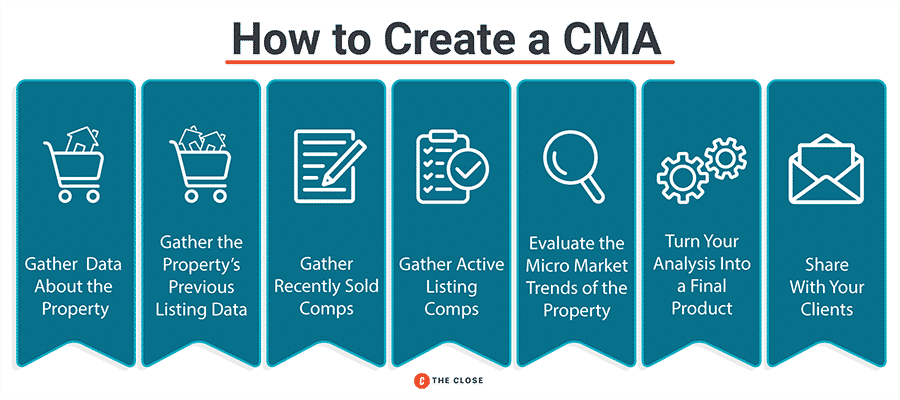

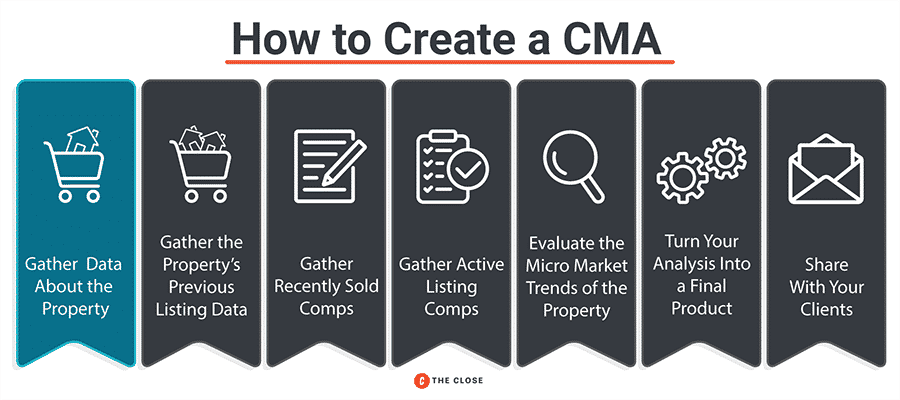

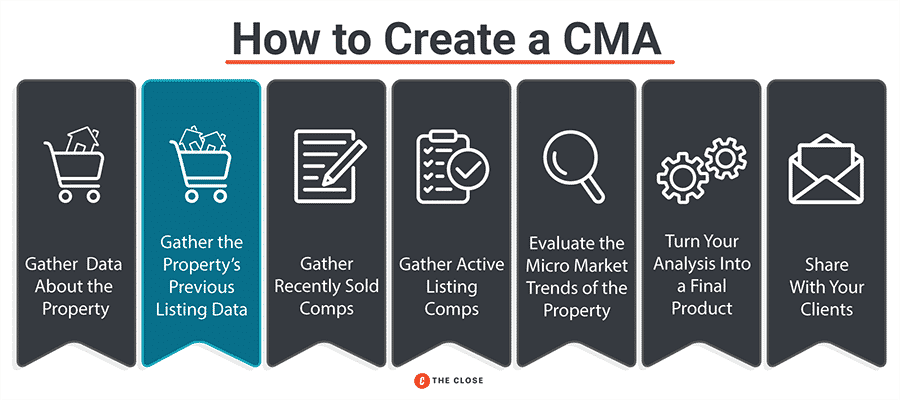

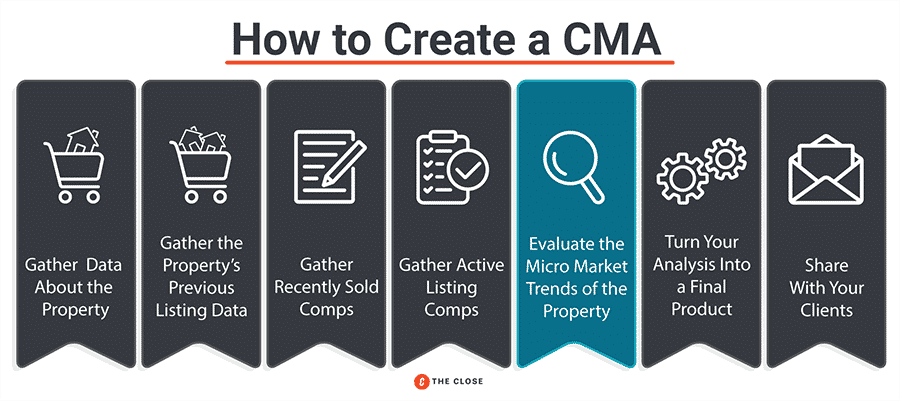

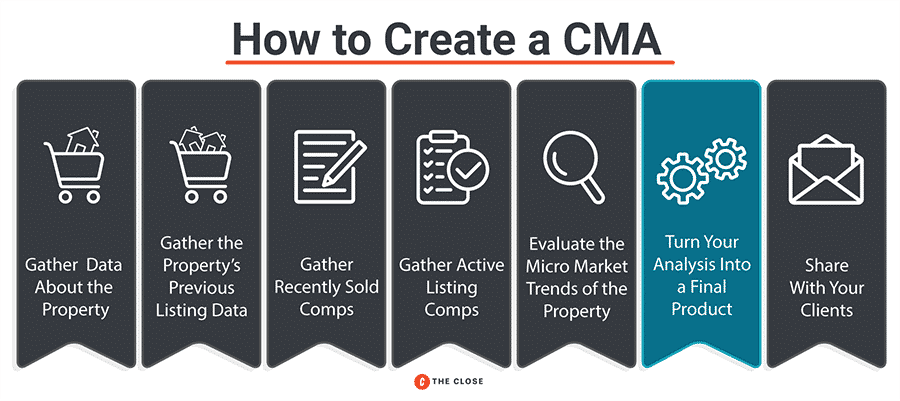

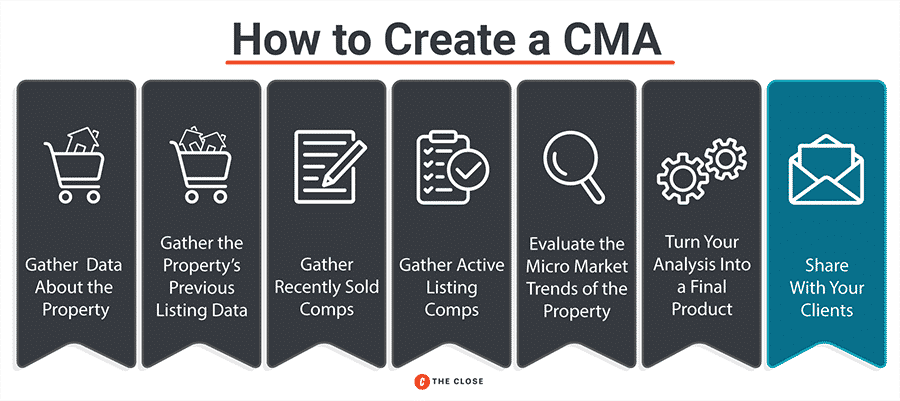

How to Do a Comparative Market Analysis in 7 Steps

Now that we know what a CMA is and why it’s so helpful, let’s dive into exactly what you need to write a comparative market analysis that will impress any homeowner.

1. Gather All the Data Available About the Subject Property

“Subject property” is CMA-speak for the property for which you’re determining the market value. Since the critical function of a CMA is comparison, we first need to learn everything about the subject property so we can find other comparable ones with which to compare it.

How We’ll Use Subject Property Data in a CMA

Using Subject Property Data, we’ll compare the property whose value we’re trying to estimate against other, similar properties that have either recently been sold or are currently on the market. Knowing everything we can about our subject property will allow us to make better comparisons later on.

Remember, if you want to determine a home’s value, much less sell it, you need to be an expert when it comes to every detail. The more you know about a property, the better you’ll be able to gauge its value relative to similar, recently sold homes, as well properties currently on the market—not to mention its value relative to overall market trends.

Action step: Gather all the information you can about your subject property. At a minimum, you need the following data points:

- Location (street, neighborhood, municipality, county)

- Total square footage

- Number of bedrooms and bathrooms

- Acreage (if privately owned)

- Year built

- Renovations or major changes since the last time the home was sold

- Interior finishes of note

- Any extraordinary features (swimming pool, pole barn, and so forth)

- Current taxes paid / millage rate

2. Gather Your Subject Property’s Previous Sale / Listing Data

The best indicator of what the market will bear for a particular property is the market itself. A subject property’s previous sale and listing history provides insight into what the market has (or hasn’t) supported for the property in the past. It also helps us start to estimate the home’s value relative to the movement of the entire market since the last time the subject property changed hands.

How We’ll Use a Subject Property’s Previous Sale / Listing Data in a CMA

Using our Subject Property’s Previous Sale Data, we’ll estimate the first dimension of a home’s value based on the market’s overall movement since it was last sold.

For example, say your subject property was last sold five years ago. The median home price for your subject property’s market niche was $200,000. Today, the median price for that same niche is $210,000. With an increase of 5%, we can surmise that our subject property’s value might follow the same trend.

Action step: Gather all the information you can about your subject property’s previous sales and listings. At a minimum, you’ll need the following:

- Previous list price(s)

- Previous sold price(s)

- Property details

- Price adjustments

- Days on market

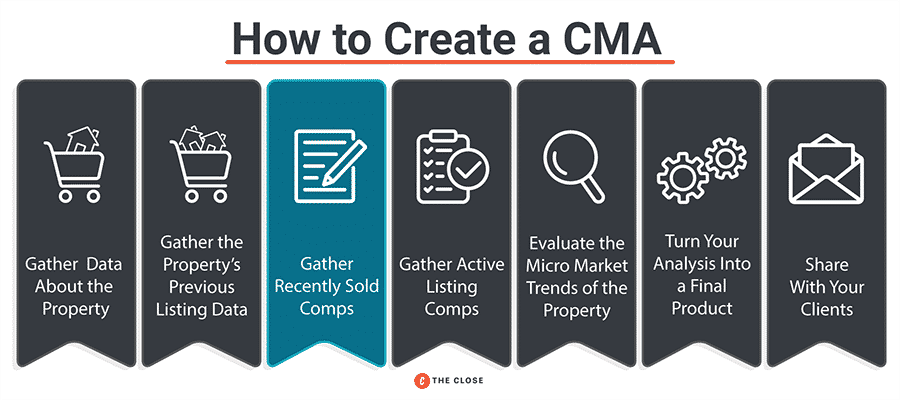

3. Gather Recently Sold Comps

Second only to understanding your subject property, having relevant comparable sales (or “comps”) is the next most important step in conducting an accurate comparative market analysis. Comps are properties with primary features that are identical, or at least very similar to those of our subject property.

A solid comp is a property that has been:

- Sold in the last 12 months (or, in fast-moving markets, the last six months),

- Near to your subject property on the map, and

- Closed within a reasonable number of days on market and sale terms.

The more dissimilar a comp or property is to your subject property, the worse it will be for predicting your property’s value.

How We’ll Use Recently Sold Comps in a CMA

Using Recent Sold Comps, we’ll estimate the second dimension of our property’s value based on what the market has recently borne for equivalent (or similar) property.

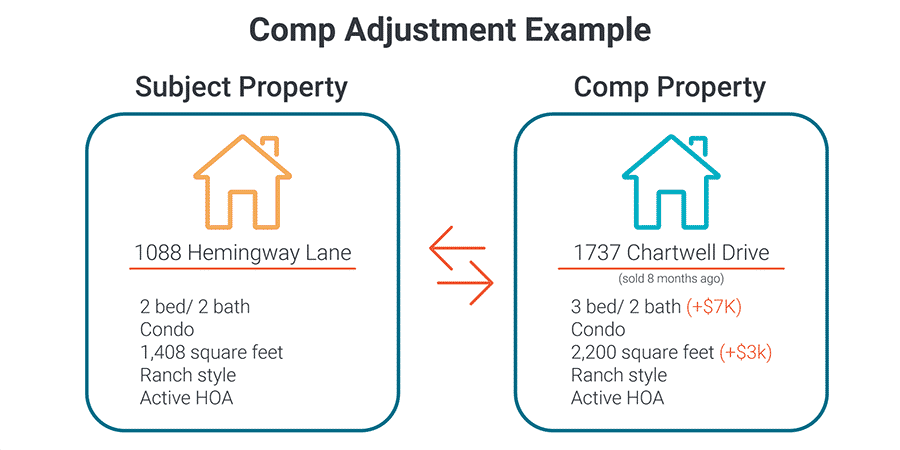

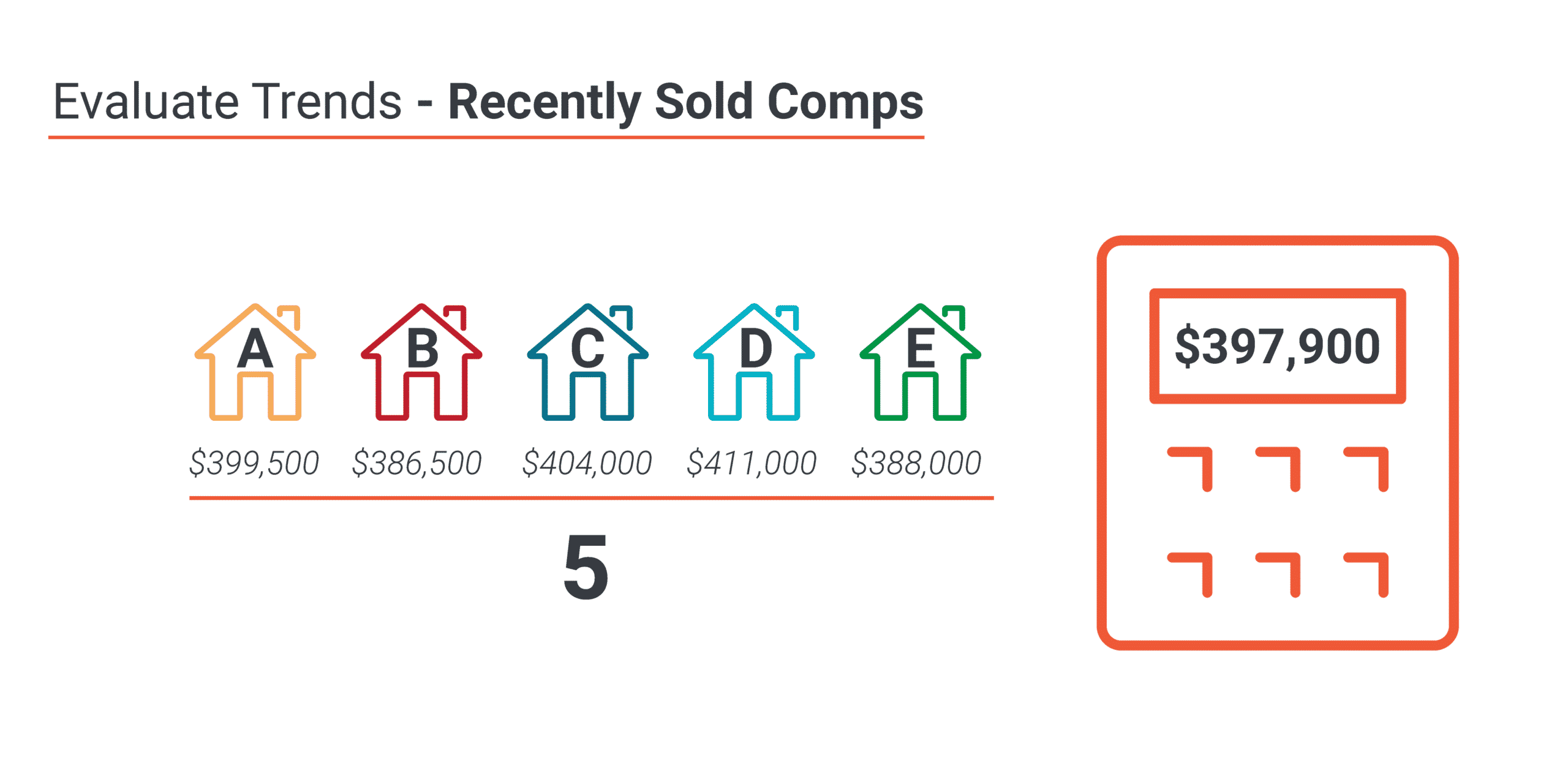

Action step: Using your MLS, find four or five sold properties that match your subject property in terms of the critical criteria we identified back in step one, going back one year. Why only a year? We all know how fast the market changes. You want the most recent sales data you can find since you’re looking to determine what the market value of a home is TODAY.

Criteria like acreage, square footage, and new amenities with specific price tags (like a new roof or new appliances) are easy to adjust for, while subjective attributes (like architectural design and landscaping) are harder to adjust for.

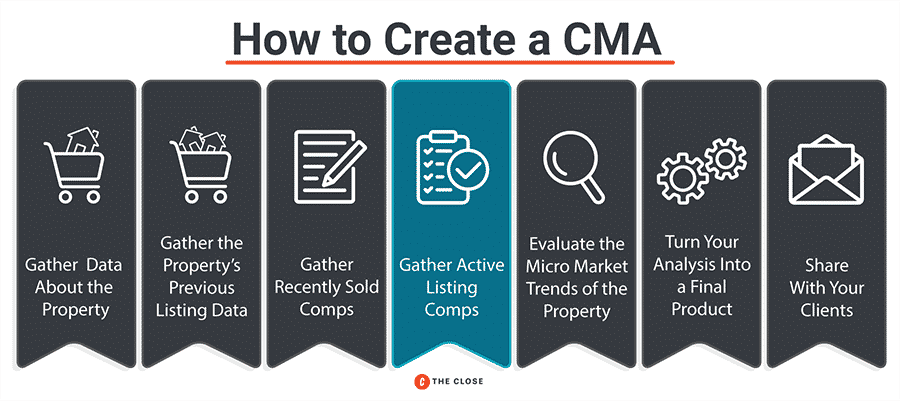

4. Gather Active Listing Comps

An Active Listing Comp is just like a Recently Sold Comp except that it is, as you may have guessed, currently on the market. Active Listing Comps are important to the CMA process because they give us insight into what our subject property would likely see in terms of activity in the current market conditions.

How We’ll Use Active Listing Comps in a CMA

Using Active Listing Comps, we’ll estimate the third and final dimension of our property’s value, based on the current market’s reaction to similar listings. We’ll also gauge the level of competition we’ll face should we enter the market at various price points.

Action step: Using your MLS, find four or five active properties that match your subject property in terms of the critical criteria we identified back in step one. Ideally, these properties haven’t been on the market longer than twice the median days on market for similar listings. The best Active Listing Comps are ones that are currently under contract, but not yet sold.

5. Evaluate the Micro Market Trends of Your Subject Property

The term “micro market trends” sounds high falootin’, but it’s really just a fancy way of saying “keep in mind what’s happening in the neighborhood.”

For example, let’s say there’s major road construction down the block from your property. Despite the overall trend of the market improving in your neighborhood, this micro market trend may drive down the final number on your comparative market analysis.

Likewise, if your subject property is located in a building that recently instituted a 24-hour doorman service, that’s going to drive the price of the apartment slightly over the price of the market research you’ve done so far.

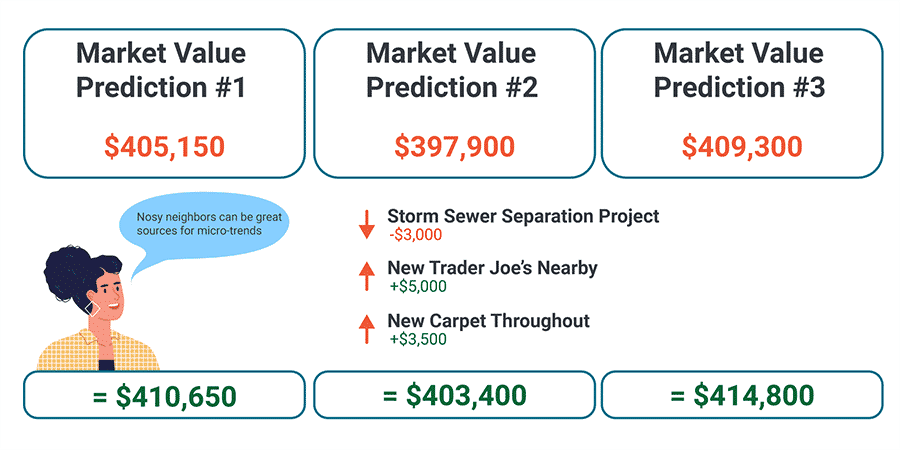

How We’ll Use Micro Market Trends in a CMA

Using this knowledge, we can adjust our overall value predictions up or down relative to our findings.

Action step: Collect answers to the following question: “Is there anything happening in the immediate area of your subject property that would drive the price of the home up or down? If so, by how much?”

6. Put the Pieces of Your Comparative Market Analysis Together Into a Final Product

Nice work, you’ve done all the research necessary to put together a fantastic CMA. You know all the details of your subject property, you understand the recent sales history of similar properties, you know what the market is currently offering in terms of comparables, and you know what might affect the sale price of your property locally.

So, how do we pull all this information together into a final result?

A. Start With Your Subject Property’s History

First, start with the sales history of your subject property. Median prices have risen (or fallen) a certain percentage since your property last sold. Based on this (taking into account any renovations or alterations that have been made to the subject property), what should the current value be? This number will be the first in your property value prediction range.

Here’s an example:

B. Move to Your Recently Sold Comps

Next, take a look at your comps for recently sold property. Based on what you’ve found, what does the value of these properties indicate about the value of your subject property? This number will be the second in your property value prediction range.

Here’s an example:

C. Look at Your Active Listing Comps

Repeat the previous step, but use the comps you’ve pulled from the active market. This number will be the third in your property value prediction range.

Here’s an example:

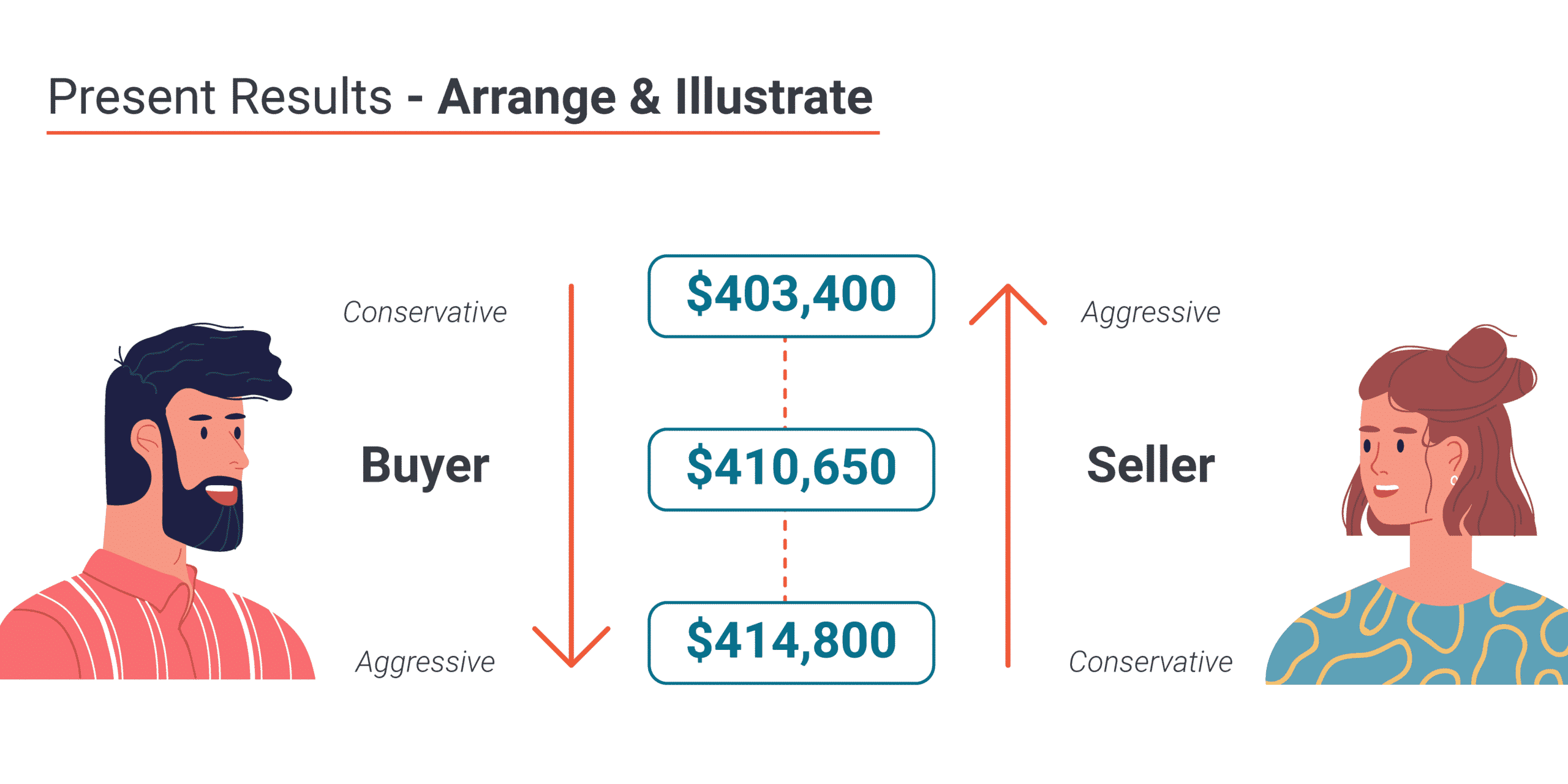

D. Arrange Your Predictions From Lowest to Highest

If you’ve been thorough and consistent in your market research, you should see a trend emerge with three numbers all reasonably close to one another. Arrange these numbers from lowest to highest to get a conservative, moderate, and aggressive market value for your subject property.

E. Don’t Forget Your Micro Market Trends

Finally, apply any Micro Market Trends to your predictions.

7. Package Your Results & Share With Your Clients

We get it. By now, you’ve likely got a desk covered in papers, a web browser with 20 tabs open, and a head full of data—but hallelujah, you have your results! However, you can’t just hand your client a range of numbers. They need a presentation, they need context, and most of all, they need to understand how you got to the answer you’ve provided.

Much like your eighth grade math teacher demanded, you’re going to need to show your work. That’s why The Close has put together a handy CMA presentation template that, in just a few pages, will give your clients or prospects all the information they need to understand how you arrived at your CMA results and determined a price range.

Get Your CMA Presentation Template

Comparative Market Analysis FAQs

Even though you’re now an expert in all things CMA, we know you might still have questions. Here are some of our most frequently asked questions (and helpful answers) we get asked about comparative market analyses.

What’s the difference between a comparative market analysis & an appraisal?

There are subtle but important differences between a CMA and an appraisal. An appraisal is performed by a licensed appraiser, usually to understand the current value of a property for the purpose of lending or insurance. A comparative market analysis is performed by a real estate agent or broker for the purpose of determining a list or selling price based on comparable sales and market trends.

The range of my three numbers is too wide. What do I do?

When your CMA range comes back too broad to be helpful, it’s usually an indicator of one of two things: Your comps aren’t similar enough to your subject property or you’re inaccurately estimating the growth (or contraction) of the market since your subject property’s last sale.

Go back and check both angles again to see if there are better comparables out there or if your estimation of the overall market movement could be refined and improved.

What’s the most important property trait I should consider in my comparative market analysis?

Location plays the most important role in determining the value of a property. A property’s location determines how far it is from schools, hospitals, and the beach. It also determines the home’s property taxes. When seeking comparable properties to use in a CMA, finding ones with equivalent locations is a must.

How many comparables should I use in my comparative market analysis?

The more comps, the better. Actually, I should temper that by saying, the more comps, the better—as long as they’re ACCURATE.

There is often a temptation to use a TON of comps when doing a CMA, but in doing so, it’s easy to include a property that isn’t quite similar enough to your subject property. Remember, making apples-to-apples comparisons is key to the CMA process, so don’t start throwing oranges in there just to impress your client with a full bag.

A good number of comps is between three and five for sold properties and the same for currently listed properties.

Where should I get my comps data for my comparable market analysis?

Whenever possible, you should get your data from your local MLS. Even though Zillow is a great place for consumers to get data on property (and a great place for you to pick up leads), your MLS is going to have much more detail on each listing.

Also, third-party sites often don’t provide a history of a property’s price changes and total days on market. You’ll want to consider both items when finding comps for your comparative market analysis.

My results are different from my colleague’s results. What gives?

Remember, even though a comparative market analysis uses objective information like square footage, acreage, bedroom count, and the like, they’re ultimately a tool that relies on subjective feedback from you, the real estate professional.

For example, when you’re considering a comp that’s similar to your subject property in every way except that it has an extra bathroom, what value do you assign that bathroom in your adjustment? Your colleague may adjust it differently than you do, or perhaps, not even choose that comp in the first place.

If your conclusions are different from other real estate agents, don’t fret. The market will demonstrate who was closer to the actual value. Trust in your process, and if the market gives you constructive feedback about your final numbers, find where you need to make an adjustment in your CMA process to make your next CMA even better.

Final Thoughts

Answering the question of “how to do a comparative market analysis” isn’t easy, but it is answerable. You’ve now got a thorough understanding of how you can better estimate the value of a property in your market. Take this information to make your sellers’ list prices more accurate and your buyers’ offers more competitive.

Got more questions? Join our Facebook Group, The Close Real Estate Agents Mastermind Group, and continue the conversation.