What is GCI? It stands for gross commission income and it’s the amount of money a real estate agent receives in exchange for their services in a real estate transaction as a representative of a buyer, seller, or both. Most often, the GCI for a property sale is calculated by multiplying the commission rate by the final sale price.

But there’s so much more to understanding this key calculation and why it matters to every real estate agent. We’ll explain the difference between GCI and the more complicated NCI (net commission income). We’ll also give you a handy calculator and a formula to help you calculate the GCI and NCI on your next property sale.

What Is GCI + Basic GCI Calculator

We’ve given you the basic definition of gross commission income. Now, let’s dive a little deeper to understand what’s so important about this key measure for real estate agents. As we mentioned, GCI is the total commission paid as a result of a real estate transaction. In the simplest of terms, GCI is calculated by multiplying the commission rate by the final sale price of the property.

For example, if the commission rate for a particular listing is 6%, and the final sale price is $250,000, the GCI would be:

$250,000 x .06 = $15,000

Basic GCI Calculator

Want to calculate your own basic GCI? Fill in your final sale price and commission rate below.

When & Why GCI Can Get a Little More Complicated

Even though the basic GCI calculation is pretty simple, several situations can impact this otherwise straightforward formula, including your split, seller concessions, and more.

For example, let’s say the total commission paid on your new listing is 6%, but another agent brings the buyer. In this situation, that 6% commission is divided between two parties. The gross commission income for each agent is now calculated by dividing the original 6% in half (assuming the listing agreement spells out an equitable split between both sides).

Other factors could affect your GCI. Say you’ve got a seller concession of 2% of the sale price to cover the cost of some repairs. Depending on how the repair addendum is written, the 2% concession may or may not be included in the commissioned sale price.

When figuring your GCI, anything that affects the final amount upon which the commission is calculated must be taken into account.

GCI vs NCI: What’s the Difference?

Your net commission income, or NCI, is the dollar amount that’s left over from your gross commission income after everyone other than you gets their piece of a real estate commission.

Though every agent and every transaction is unique, let’s look at a typical list of expenses paid from the GCI to calculate your final NCI.

- Broker split: In most situations, agents are sharing at least a portion of their commission with their broker until they’ve reached their cap for the year. If this doesn’t make any sense to you, no worries. Check out our article all about how brokers and agents get paid for more info.

- Team split: If you’re an agent on a real estate team, you’re likely to have a secondary split with your team, as well. This number usually gets rolled into your broker split, but it’s worth mentioning. For more information about this, check out Sean Moudry’s article about real estate team structures, where he covers team splits.

- Transaction fee: Some brokerages charge a flat fee per transaction for their agents. This usually covers things like office rent, utilities, and services.

- Commission-based referral fees: If you had a referral fee, either from another agent or from a lead generation service like Zillow Flex, that will be paid and deducted from your GCI. Don’t know about Zillow Flex? Check out our long-form analysis.

- Commission-based marketing fees: In a hot seller’s market like the one we’re experiencing now, some marketing professionals offer their services with ‘no upfront cost’ payment options. For example, photographers and videographers might offer this payment option as an enticement in exchange for higher rates paid when a property closes.

- Taxes: Uncle Sam needs his cut of every transaction. Remember, make sure you figure taxes as a final step. Why? Because you’re only taxed on the income that you actually net, not on any on your gross income calculation or GCI.

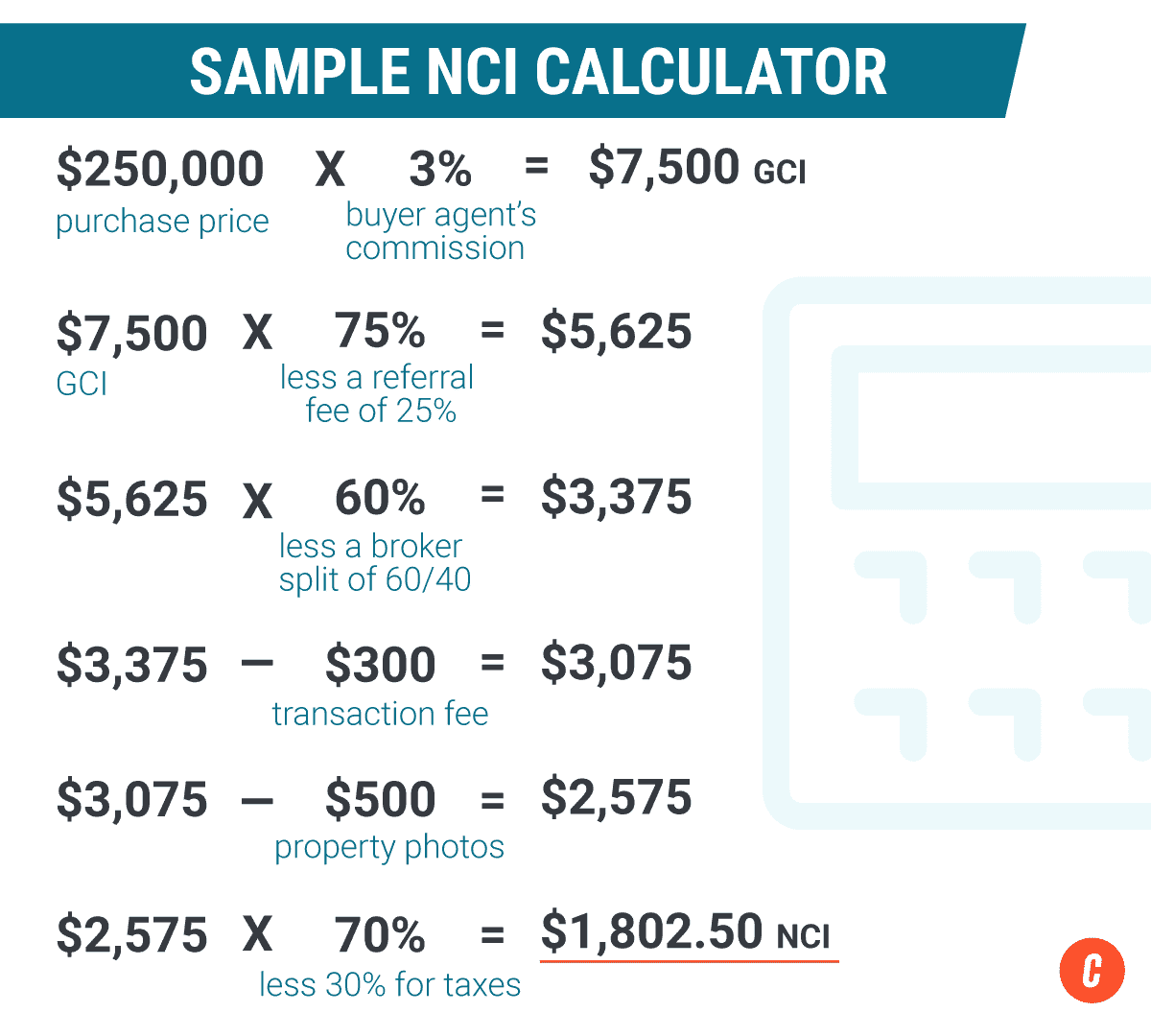

Sample NCI Calculation

When figuring your net commission income (NCI), a sample calculation would look something like this:

Why GCI Matters for Real Estate Agents

If you’re a real estate agent working with a traditional cap and split agreement, knowing your GCI is essential for business planning.

When most real estate agents sign on with a brokerage, they negotiate both their cap and their split with their broker.

Their split is the percentage from each commission they earn that goes to their broker. A typical split is anywhere from 50 / 50 for new agents to 80 / 20 for experienced top producers.

Their cap is the total amount of money an agent will pay via commission to their brokerage in a given year. A typical cap for a mid-sized, non-metro brokerage is between $20,000 and $30,000.

In the example above, we used a typical home sale price of $300,000 and a typical commission rate of 3%. Assuming there’s no referral fee to be paid, a gross commission ($9,000) would be split between the broker (40% – $3,600) and the agent (60% – $5,400).

This split would occur with each transaction until the agent hits their cap of $25,000. At this rate, it would take seven transactions for the agent to reach their annual cap.

[Related Article: How to Compete With Discount Agents & Close More Deals in 2022]

Tracking Your GCI Allows You to Track Progress on Your Cap

Keeping track of your gross commission income or GCI throughout the year allows you to understand how close you are to meeting your cap requirements.

Why is meeting your cap such a big deal? In most brokerages, once you “hit cap,” you no longer have to split your commission with your broker, putting significantly more money in your pocket at the successful close of each transaction.

This shift impacts how you’ll plan your expenditures throughout the year. Knowing your cap helps you be more strategic in your marketing and budgeting. Ultimately, it gives you the tools you need to plan your business further forward than a single transaction at a time.

Other Reasons Why It’s Important to Track GCI

Tracking your progress against your cap is undoubtedly valuable, but it’s not the only reason why realtors should be paying attention.

Measuring Your Success Rate Compared to Other Agents

In the real estate industry, an agent’s success is often measured by their GCI. When you hear someone referred to as a “million-dollar agent,” they’re not referring to the price point of the homes they sell. They’re referring to that agent’s typical annual GCI.

GCI is the measure of choice because it levels the playing field among agents working in markets with vastly different price points. An agent working in the luxury condo market in Miami might only sell 10 units a year (a paltry sum for some markets), but if those units each close for $5 million or more, that agent is likely grossing far more than a million dollars.

Using GCI as a measuring stick makes it easier to compare an agent’s actual success rate. Is this the only way we should judge an agent’s success? Certainly not. But it’s a universally identifiable metric, so it’s important to know.

Long-term Growth Planning

GCI is essential to individual agents, teams, and brokerages trying to grow their business. Without knowing this number, it’s challenging to set goals. Knowing the relationship between your net commission income and your gross commission income will help you understand what’s required to reach your personal and professional goals.

Designation Qualification

Finally, you’ll need to reach a specific volume of transactions and GCI to qualify for certain real estate designations, like the CCIM designation. Keeping track of your GCI and the perks of reaching specific GCI benchmarks is a great way to advance your real estate career.

You’re an Expert on GCI, Now What?

Now that you’re in the know about what GCI is and why it’s important to keep track of it—what do you do with this new-found expertise?

First, you should evaluate your business plan to make sure you’re taking advantage of your expected cap date. You can use this information to better craft your real estate business plan, set up better spending strategies for lead gen companies like Zillow Premier Agent and BoldLeads. Even better, you can adjust your real estate farming strategy based on how much additional revenue you’ll have available.

Finally, you can use this information to negotiate a better cap / split deal with your brokerage, or even consider whether a low-cost virtual brokerage like eXp or REAL are appropriate options for you. If you have questions about choosing a brokerage, make sure to check out our Best Real Estate Companies to Work for in 2022 article.

Your Turn

Do you closely track your GCI? What do you do with that information? Tell us in the comments below.

Add comment