One of the most common questions we get from real estate agents these days is when, or even if, bitcoin will finally make its way into real estate transactions.

Of course, if agents are asking us that, it means their buyers and sellers are probably asking them. So it’s only a matter of time before understanding how this technology works will be necessary for any agent who doesn’t want to get left in the dust of yet another disruptive technology for real estate.

The only problem is that bitcoin is—and there’s no other way to say it—confusing. Don’t worry, though. Even people who are so-called experts in the field can have a hard time explaining it.

That’s why we put together this quick explainer on bitcoin for real estate agents and also talked to a few agents and brokers who have already taken the leap to get their take on how they think bitcoin will transform the real estate industry in 2022 and beyond.

Can My Buyers Purchase a Home With Bitcoin Yet?

Kind of. However, almost all real estate transactions using bitcoin have used a service called BitPay to convert bitcoin to U.S. dollars (USD) to transfer funds to the seller.

As far as “bitcoin-to-bitcoin” transactions go, where title changes hands and the bitcoin is never converted into USD—they still remain very rare. The sticking point is generally title companies and lawyers, both of whom are still somewhat reluctant to use the digital currency.

Douglas Elliman’s Stephan Burke and Carol Cassis sold the first property using bitcoin wallets in 2017, as well as a $6 million transaction after that, the largest fully bitcoin translation to date. Since then, they have closed more than $34 million in volume using cryptocurrency converted to cash.

However, while it has been slow going here, where bitcoin and blockchain show the most promise is for overseas transactions.

Over at the always excellent Mansion Global, EminGun Sirer, associate professor of computer science and co-director of the Initiative for Cryptocurrencies and Smart Contracts at Cornell University, weighed in on why cryptocurrencies are ideal for foreign buyers:

“Cryptocurrencies enable the quick, frictionless transfer of value across the globe. This enables someone in Russia to be able to easily send bitcoins to purchase land in Belize.”

– EminGun Sirer

Should I Advise My Sellers to Accept Bitcoin?

In today’s market, bitcoin may not be ready for prime time, but there is one thing that is undeniable. Offering your listing for sale in bitcoin will get you instant free press. Remember the first listings that had drone videos? Imagine that times 10. Here’s Seattle Realtor, Sam Debord:

“I’ll sell my house for bitcoin” is the latest marketing tactic, and it’s working … at least for publicity.”

– Sam Debord

In order to accept bitcoin, you can either have the seller transfer into USD, work with a title company that will accept bitcoin, or have a lawyer write up a contract that covers all risks from bitcoin. At this point, most people will avoid actually paying in bitcoin, but the free press might be a good trade-off.

Can My Buyers Get a Loan With Bitcoin?

Yes. Startups like Unchained Capital allow people who hold bitcoin to borrow up to $1 million with no credit check and interest rates between 10% and 14%. However, these are not long-term loans; Unchained offers loan lengths ranging from three months to three years.

While not for everyone, hardcore bitcoin owners use services like this to get quick liquidity without cashing in their bitcoin portfolios. Think down payments, or maybe even bridge loans.

There Must Be a Catch … Is There Capital Gains Tax for Transferring Bitcoin to USD?

Yes. As of January 1, 2018, the federal government considers cryptocurrency as property and anyone selling (or trading bitcoin for U.S. dollars) will be hit with capital gains tax on the amount their bitcoins appreciated since they purchased or mined them.

Are Bitcoin & Blockchain the Same Thing?

No. While bitcoin is a digital currency that you can exchange for goods and services, blockchain is the underlying technology that stores bitcoin or other cryptocurrency transactions in a digital ledger.

Okay, Then What Is Bitcoin Exactly?

Bitcoin is a fully digital currency created in 2009 by an anonymous person who goes by the name Satoshi Nakamoto online.

Like any other currency, bitcoin can be used to pay for goods and services, transfer funds, or as an investment. Currently, over 15,000 vendors accept bitcoin, from Microsoft to small businesses.

The main difference between bitcoin and say, an ACH transfer through a traditional bank is that there is no middleman in the transaction. The entire transaction from buyer to seller takes place on the Bitcoin network. Since a bitcoin transaction bypasses the different bank policies, or different regional banking laws that are part of any other transaction, transfers are much faster.

Since there is no bank or government to get in the way, bitcoin can be a great way to transfer money or make purchases overseas. Foreign buyers may find bitcoin’s speed and simplicity ideal for buying property in the United States.

Bitcoin is an example of a fiat currency; its value is not backed up by gold or other tangible asset. Instead, bitcoin relies on something called blockchain to verify transactions.

Got It. So What’s Blockchain?

Although blockchain is very complex, the best way to describe it to your clients is to compare it to ACH, the technology that lets you “wire” money from one bank to another. The main difference is that blockchain does not rely on banks to verify transactions have been completed. Instead, once a transaction is completed, it is stored in an encrypted digital ledger that is distributed among everyone on the blockchain.

This means that instead of relying on trusted institutions like banks to verify transactions, the verification is done very quickly by algorithms that check the stored transaction data on the millions of users on the blockchain.

What makes blockchain so powerful is that the ledger is stored on every single computer (node) in the system. This makes faking a transaction virtually impossible. Since the blockchain is extremely secure, it has many applications beyond verifying and storing bitcoin transactions. Everything from contracts to voting records can theoretically be stored on blockchain.

Which Technology Will Have a Bigger Impact in the Real Estate Market, Bitcoin or Blockchain?

According to most experts, blockchain will have a bigger impact on real estate than bitcoin or other cryptocurrencies. Here’s why: Transaction speed is not a very pressing problem for real estate transactions, but record keeping and middlemen are. Here’s Jason Shepherd, co-founder of Atlas Real Estate Group, on why he thinks blockchain technology, particularly smart contracts and other applications built on Ethereum, an alternative to bitcoin, will change the real estate market:

“It is important to separate the cryptocurrency from the underlying blockchain technology when discussing real estate disruption. The disruption in real estate will come from the blockchain technology (distributed ledger) and smart contracts like those found on the Ethereum platform.”

– Jason Shepherd

So What Are Smart Contracts?

Smart contracts are contracts between two parties that are verified and stored on the blockchain. Today, most smart contracts are built with the blockchain protocol behind Ethereum, another cryptocurrency.

The main benefit behind smart contracts is that there is no need for a middleman in the transaction. Everything is verified and stored on the blockchain.

In the future, blockchain can be used to store records of a transaction all the way from a blockchain-enabled MLS, to escrow, inspections, title, and sales contracts. Leases and other commercial real estate contracts could also be on the blockchain.

While smart contracts haven’t yet hit the mainstream for real estate, startups like Propy and Ubiquity.io are changing that.

To learn more about smart contracts, check out this excellent guide over on Block Geeks.

What Is This ‘Mining’ for Bitcoins I Keep Hearing About?

OK, from here on in, the process gets a bit more technical, and therefore much harder to explain. While it’s unlikely your buyers or sellers will grill you about this, having a basic understanding can help.

Remember how we talked about how transactions on the blockchain are verified by other users? Well, bitcoin mining is the process that verifies transactions and adds them to the public ledger.

Bitcoin “miners” are rewarded with bitcoin for using their computer’s processing power to verify transactions. Before you get too excited and start mining bitcoin out of your broker’s office, understand that in most places, the payment for mining bitcoin will probably be less than the electricity costs to run computers long enough to verify transactions.

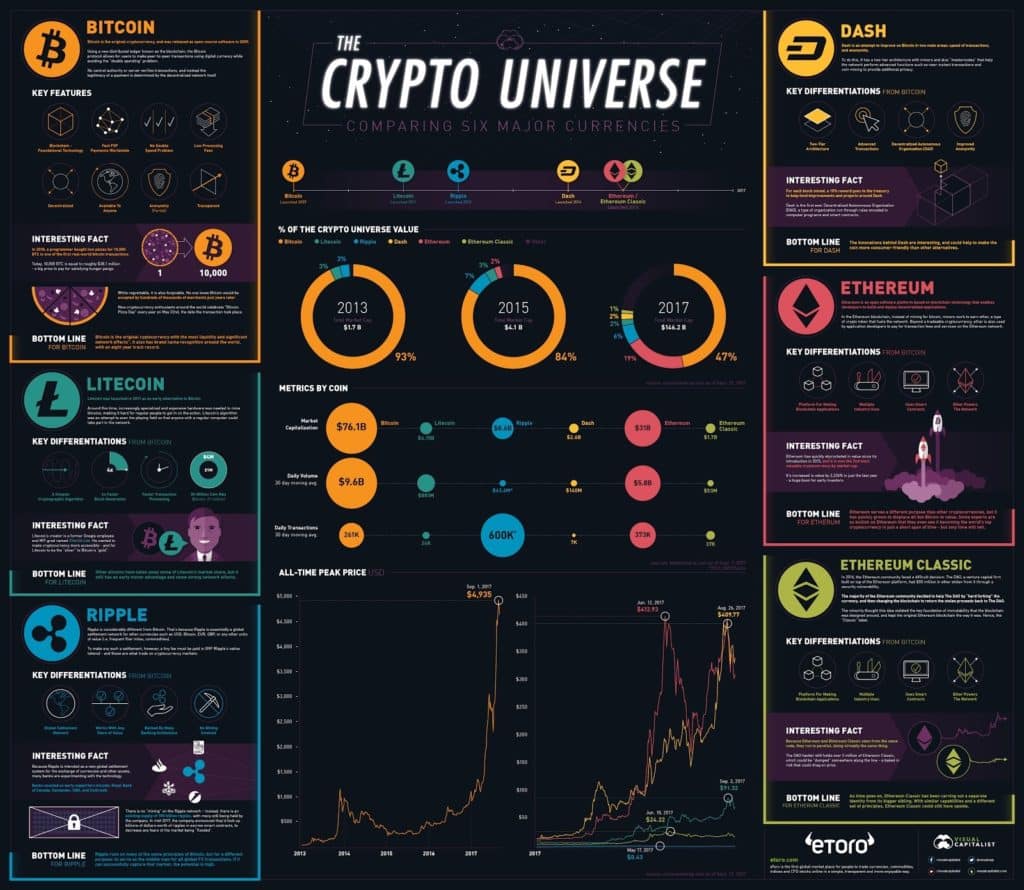

What Advantages Do Other Cryptocurrencies like Ethereum, Litecoin & Ripple Have Over Bitcoin?

OK, now we’re getting a little too far into the weeds. Worse, the crypto industry changes so fast that by the time you read this, something will have inevitably changed. If you’re feeling brave, check out this cool infographic from Visual Capitalist:

How 10 Real Estate Experts Think Bitcoin Will Disrupt the Industry

So now that you have a basic understanding of bitcoin, here’s how 10 real estate industry experts see bitcoin transforming the real estate market in the coming years.

1. Jason Penner, Douglas Elliman, New York City

2. Jim Merrion, Coldwell Banker Realty, Colorado

3. Tristan Ahumada, Realtor, Speaker & Co-founder of LabCoatAgents

4. Jason Shepherd, Co-founder of Atlas Real Estate Group

5. John Gilbert, Co-founder/Director Prime-EX

6. Avani Desai, CEO & Co-founder of MyCryptoAlert

7. Alan Lewis, Chief Investment Officer at DiversyFund

8. Sheryl Lowe, Broker Associate, Kuper Sotheby’s International Realty

9. Hyun Lee, Communications & Marketing Director, Mothership Foundation

10. Dr. Lucas Lu, Founder/CEO, 5miles

Bottom Line

No matter how much you fight it, bitcoin and the blockchain technology it runs on will revolutionize the real estate industry. Since your buyers and sellers will be curious about the potential of bitcoin for their transactions, agents need to have a basic understanding of how this technology works. This will not only allow them to represent their clients better, but also help attract and retain tech-savvy buyers and sellers, and create a buzz with marketing.