In my 26-year career as a broker and real estate coach, I have never seen anything like today’s market. Even in a normal market, all pendings don’t make it to closing. Now, add in a global pandemic that caused the lowest interest rates we’ve seen in our lifetimes, and the result is massive buyer demand mixed with overwhelmed contractors and lenders.

These market conditions create a perfect storm for unexpected problems that can delay, or even kill, your pending deals. In this article, I will teach you how to avoid some common pitfalls, increase your closing ratio, and bulletproof your pending transactions.

1. Have the Investigations Done the First Week

If you are proactive, you can overcome the majority of obstacles the current market is creating the first week you are under contract. If both parties are prepared, it is possible to complete the inspection, title insurance, hazard insurance, and homeowner’s association (HOA) investigations all within the first seven days of the contract.

If you represent the seller, you can prep by having the HOA bylaws and covenants available for buyers to review even before the property is active. You can also get the title policy started by contacting the title company and ordering an Owners and Encumbrances report (O&E). This report will show any liens that the seller may not know about. Surprise liens can definitely kill your deal. The goal is to move the buyer through the investigative process quickly.

You can also speed up the investigative period by having the buyer contact their hazard insurance company for an estimate prior to being under contract. Another tip is to have the buyer reserve the property inspection appointment while you are writing the offer. The buyer can always cancel if the offer isn’t accepted. This all helps overcome the majority of the buyer’s investigations and inspections swiftly so you can get to closing quicker.

2. Order the Appraisal Early

Due to low interest rates and pent-up demand, June 2020 was one of the busiest months on record, according to the National Association of Realtors (NAR). The combination of buyers rushing to buy now and homeowners wanting to refinance and take advantage of record-low interest rates has caused some serious delays in some areas with appraisal.

If you don’t want your deal held up due to long appraisal wait times, order the appraisal as soon as possible. If you take my earlier advice and complete all the investigations the first seven days, then you should feel comfortable having the appraisal ordered at the beginning of the second week.

The seamless process of being proactive the first week and completing the appraisal by week two will set you up for the hat trick that is up next.

3. Ask to Move the Closing Up

When I was starting out in real estate, my mentor Peter always said, “Time Kills Deals.” What Peter meant was: Given enough time, things will come up that will disrupt your transaction—if not end it altogether. In my 26-year career, I’ve seen all kinds of unexpected problems kill deals. I’ve seen buyers lose their job and sellers get cold feet, all in the time between the inspection being resolved and the closing date.

To get to the closing table faster, I recommend that as soon as the investigations, inspections, and the appraisal are all complete, you ask all parties if they would agree to move the closing date forward. If possession is a concern, they can agree to keep the possession date the same and have the comfort of knowing the deal has been put to bed. Also, don’t forget to check with the lender to ensure they are good to close earlier.

This is a big ask for most agents, but has saved more than a few deals for me over the years.

4. Don’t Ask for Repairs the Buyer Can Do Themselves

Buying a home in tip-top condition is a desire for most buyers, so repair requests are very common these days. The problem is that due to COVID-19, it is becoming extremely difficult to find available contractors to make those repairs quickly. Even without the pandemic, contractor delays can hold up your closing for days or even weeks. Now the pandemic has made it worse.

Prior to going under contract on a property, coach the buyer that if the repair is not a health or safety item and if they have the ability to make the repair later, to not request the seller make the repair. Instead, coach them to make the adjustment in the offer price, explaining to the seller that they won’t be requesting repairs other than those that risk health and safety. This has an added benefit of showing the listing agent that your transaction will be a smooth one.

Another option is to request the seller to compensate the buyer by paying additional buyer closing costs, other than requesting repairs on inspection concerns. This will allow the buyer to bring less money to closing. The money the buyer saves can be used to make the repairs after the closing.

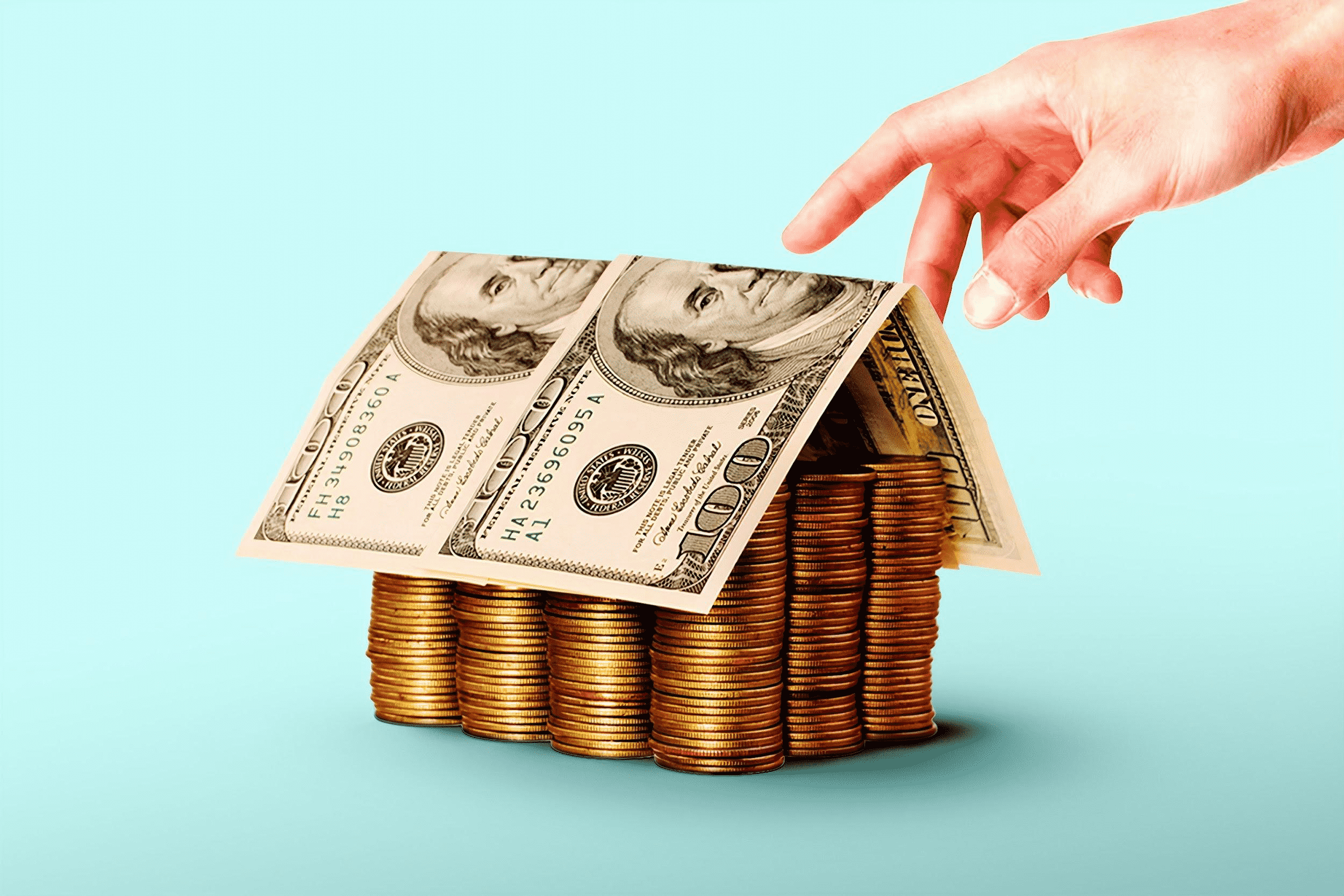

5. Price the Property to Sell

Most sellers want to get top dollar out of their property. However, for some homeowners, having the property closed by a specific date is a higher priority than getting every penny they feel they are owed.

Buyers who pay top-dollar for a home also expect it to be in ship-shape form. If it is not, when they have the property inspected, they may request a Santa’s list of repairs from the seller. Extensive repair requests can offend the seller, and you may find yourself stuck in the middle with an indignant seller and a buyer who feels they paid for a perfect house. In a situation like this, you’d probably have a better chance of getting Taylor Swift and Katy Perry to do a duo than to get that inspection resolved.

The solution is to price the home below market and make it clear to all potential buyers that the lower asking price already reflects the visible need for updating and maintenance. Sure, this may turn away buyers who are looking for move-in-ready homes, but it will also attract the right buyers who are handy and looking for sweat-equity opportunities. It also gives buyers the chance to put their own personal stamp on the home.

6. Schedule a Weekly Status Phone Call With the Other Agent

It is sad to say that even when they have a deal pending, some real estate agents are not great at communication. For example, one of the common mistakes agents make is to not notify the other party when things are just beginning to go wrong.

Maybe the buyer has a credit card that needs to be paid or they are waiting on money from a tax return that hasn’t arrived yet. Instead of contacting the listing agent and letting them know that there may be a delay, they keep it to themselves, hoping the problem will work itself out. As any experienced agent will tell you, they rarely do. Every small problem can snowball into a bigger problem if you ignore it and slow down your deal. To bulletproof your transactions, you need to pick up the phone and communicate with the other agent as much as possible.

Calling once a week instead of texting or emailing will open the door to candid conversations regarding the status of the sale, repairs, and loan conditions. When the other agent opens up about a challenge they are facing that may delay or prevent your successful sale, you will have the opportunity to offer help and guidance to save the deal.

📌 Pro Tip

Always remember: If the seller wants to sell and the buyer wants to buy, then in the bigger picture, you all have the same goal—to “keep the deal together.”

7. Educate the Buyer About Financing Pitfalls

Thanks to the internet, obtaining a mortgage today is faster than ever. However, many agents forget that most buyers do not have an in-depth understanding of financing laws, mortgage bonds, and how FICO scores are calculated. Many agents don’t think this lack of knowledge is a big deal until they get blindsided by a call from the lender that their buyer just purchased $5,000 worth of furniture on credit, and now they don’t qualify for the mortgage. Sound familiar?

In order to keep your buyers from making financial mistakes (like leasing a mid-life crisis Mobile after submitting an offer) that can derail their mortgage approval, take the time to educate them on mistakes to avoid when applying for a mortgage.

Some agents have even put together a buyer’s guide that includes the do’s and don’ts of obtaining a mortgage along with their best buying tips. Here is a great article we wrote to get your buyer’s guide started.

When you take the time to educate your buyers before they submit an offer, you can avoid headaches like this and get to the closing table faster and with fewer hassles.

8. Have the Sellers Partially Prepack & Store

Have you been in this situation? You just received an offer on your listing and all of a sudden your sellers have cold feet. Now they are second-guessing if they even want to move at all. Why does this happen right when you send them the first offer? Because, all of a sudden, the reality of moving sets in.

One way agents make this problem worse is by advising the sellers to wait until the closing date to start packing their belongings. Instead of waiting until the last minute, ask them to remove 40% of all the belongings in the house before you even put their home up on the MLS.

Make it part of your staging process. First, explain to them that a home with fewer belongings in it feels larger and allows buyers to more easily visualize their own stuff in the home. Then get them started by removing all the out-of-season clothing, decorations, and maintenance equipment cluttering up the home. Then ask them to thin out their cupboards, closets, and 30% of the furniture in each room. Have them move the extra items to a temporary storage that can be delivered later to their next home.

This will not only help make the home feel larger, it will gain a higher commitment level from your sellers. Now if your seller gets cold feet after the first offer, they have to consider moving all their belongings back in. This is usually enough of an inconvenience that they will stay on track with selling.

9. Interview the Lender

As a buyer’s agent, the last thing you want is to go under contract with buyers who are not fully qualified. As listing agents, we know better than to accept an offer without having a preapproval letter.

Let’s be honest here, though. A preapproval letter isn’t worth the paper it’s written on. The real estate community tosses around the term “preapproved” like it’s the new catch phrase from “Fuller House.” Instead of relying on the preapproval letter, I recommend interviewing the lender.

Here are a few questions you can ask the lender to make sure your buyers are actually qualified to buy:

Questions to Ask a Lender About the Buyer’s Qualifications

- What loan type are they applying for: FHA, VA, USDA, or conventional?

- Are there any additional agencies or organizations that must also review or approve the loan?

- Have all the buyers on the purchase had their credit reports reviewed by the lender?

- Have their taxes and pay stubs been checked to ensure that their debt-to-income ratios are in line?

- Have their bank statements and investments been verified for adequate down payment and reserves?

- Has this all been reviewed by the underwriter or (DU) software?

- Is the final approval of the loan only subject to the title insurance and appraisal?

- Without disclosing any personal information, are there any known items that may delay or disrupt a successful closing?

It is our duty as agents to be proactive in order to prevent delays and disruptions to a real estate transaction. Asking the lender these direct questions will quickly help you discern if the buyer is truly qualified.

Bottom Line

Today’s customers have higher expectations than customers of just 10 years ago. Missteps, delays, and inconveniences that could have been avoided are now considered completely unacceptable. Take the time in your business to bulletproof your transactions and save yourself and your clients from experiencing the pain of being unprepared.

Over to You

Do you have a way to bulletproof transactions we didn’t mention here? Let us know in the comments, or if you’re an active agent, join our Facebook Mastermind Group here.

Add comment