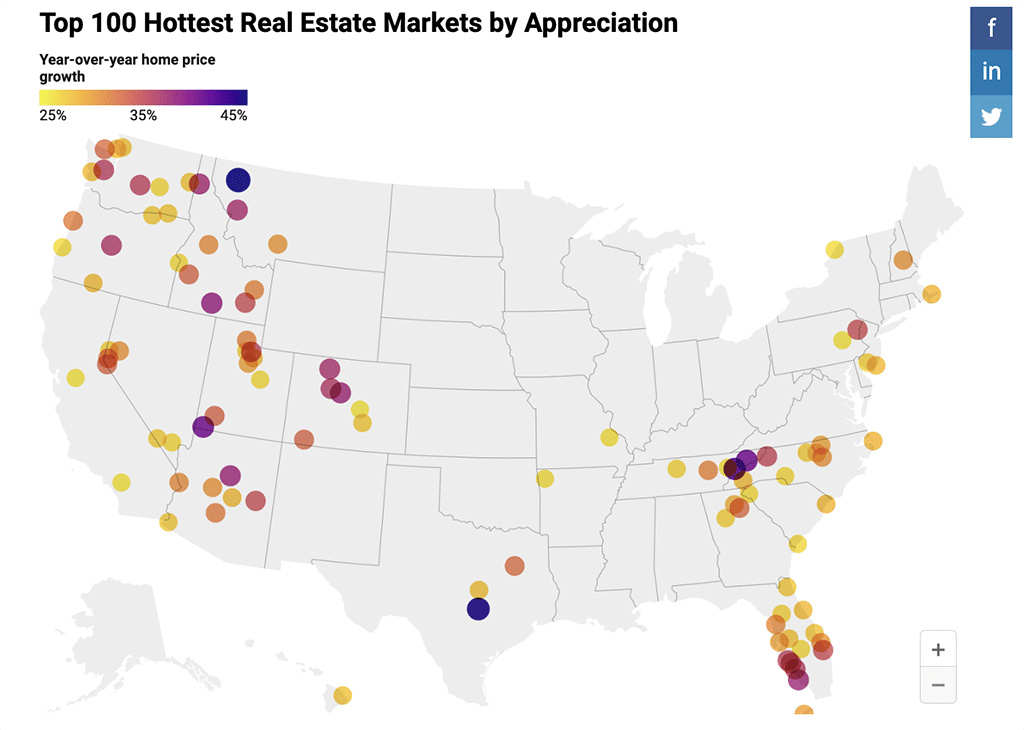

I’ve been in real estate for 27 years and I’ve never seen anything like this market. Almost everywhere you look, there are double-digit price increases. Some cities, like St. George, Utah, have seen 40% appreciation in the past 12 months alone.

These days, instead of getting asked about how to win bidding wars, my clients and friends constantly ask me if we’re in a real estate bubble that’s ready to pop. That’s why I decided to write this article explaining what a real estate bubble is, if we’re in one now, and most importantly, if or when I think the bubble might pop.

I’ll wrap up by providing some key resources I used to survive and thrive through the recession of 2008.

Free Template: Housing Market Infographic

What Is a Housing Bubble, Anyway?

A housing bubble, or speculative bubble, is defined by a steep rise in housing prices that is not supported by common or logical economic factors or fundamentals. The first recorded speculative bubble occurred in the 17th century in Holland and is now known as Tulip Mania, a period during which prices for some newly introduced and fashionable tulip bulbs climbed precipitously and then collapsed dramatically. More on this later.

2022 Market Factors Indicative of a Coming Housing Bubble Pop

Ask a real estate CEO or economist and they’ll tell you that there are many factors contributing to the current and massive housing appreciation throughout the U.S. Factors such as the sudden growth in remote work, changing migration patterns, and supply shortages are contributing to an already under-supplied housing inventory.

Increased demand and low inventory is causing regular homeowners, like you and me, to have to bid 10% to 20% over asking price to secure a deal on a home. These basic economic forces have caused home prices to rise in some areas by more than 40% in just the past year!

While these factors are indeed important, there are other factors behind the scenes that may be causing even bigger problems for the American housing market.

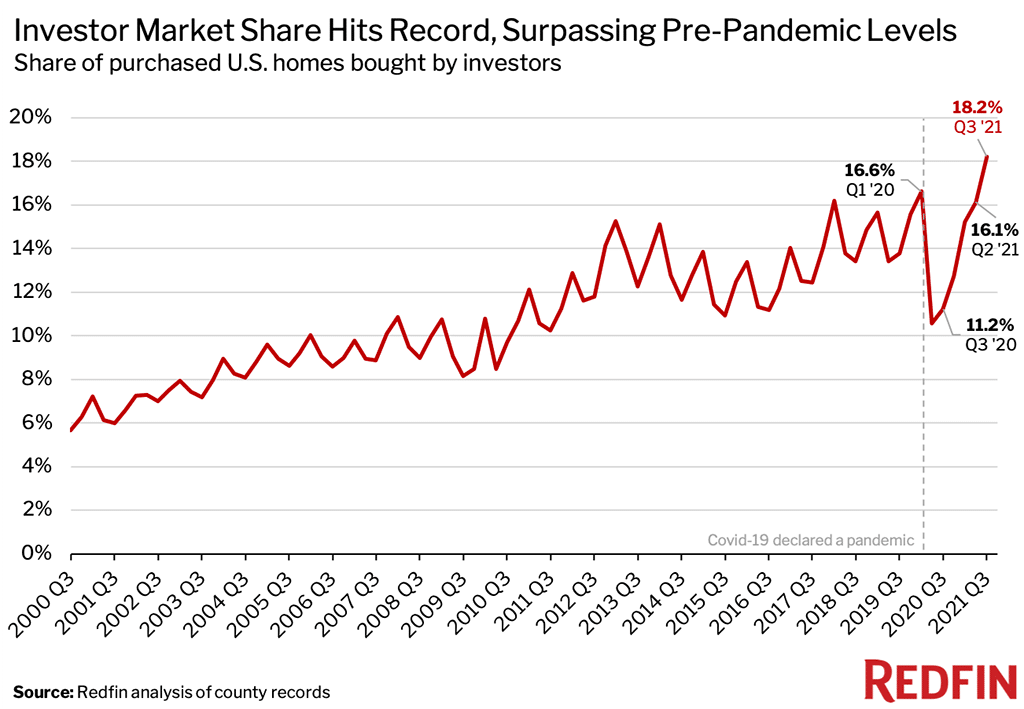

Institutional Investors Are Changing the Market

Real estate speculation is at an all-time high. However, unlike in 2008, this time it’s not from unqualified buyers who are buying property with subprime mortgages. Instead, massive institutional investors are buying single-family homes by the tens of thousands.

Looking to cash in on the high rents and a housing shortage that likely will take 20 to 30 years to resolve itself, these firms have raised BILLIONS (yes, with a B!) of dollars and are often using those funds to pay market price or above to buy homes throughout the United States.

In 2022, it is estimated that 2% (over 300,000) of all single-family homes in the U.S. are already owned by institutional investors.

It gets worse. With limited existing home inventory, some institutional investors are hiring homebuilders like Lannar to build entire neighborhoods to turn into investment rental properties.

This practice will put further strain on the already short-handed new home industry and prevent more new homes from being built for individual homeowners.

The primary concern with institutional investors is that not only are they buying housing that is further diluting housing inventory, causing inflation, and increasing rents, but when we do have an economic downturn that impacts housing values and rental income (and we inevitably will), will those investors hold the homes and developments or dump them like a truckload of bad fish?

If that happens, we could see a few hundred thousand homes hit the market in a short period of time and the housing market will have officially burst, possibly to a greater degree than we experienced in The Great Recession that began in 2007. However, I suspect that those running these institutions are smart and have planned for a future market correction.

So, Are We in for a Housing Bubble in 2022? When Will It Pop?

With low inventory and pent-up buyer demand, we are not likely in a catastrophic housing bubble in 2022… yet. However, it is still possible for values to slow and the market to correct without causing a total housing market collapse.

The main factor that could change the trajectory of housing appreciation is interest rates. With inflation still on the rise, the government has announced it will raise interest rates throughout 2022. This is highly likely to have an impact on rapid housing appreciation but not enough to make home values fall.

As we know from history, war can also slow the economy. With Russia’s invasion into Ukraine, even the threat of a U.S. war with Russia could negatively impact the rising housing market.

Overall, I agree with what Gary Keller, founder of Keller Williams, recently announced at his annual conference, “We’re not in a bubble, but we may be blowing one!”

5 Ways Realtors Can Prepare for a Potential Housing Bubble Pop

Just because I don’t think we’re in a bubble ready to burst doesn’t mean you shouldn’t be prepared for one. World events like the war in Ukraine, rising gas prices, and inflation might put a damper on the confidence and qualifications of buyers.

In 2007, the market had more buyers than listings. Builders were selling homes by lottery, and real estate agents were living large—and so was I. Like many others, I owned multiple properties and I was building custom homes on the side for big profits.

As agents, we knew that 100%, no-document lending was wrong, but we didn’t know the consequences. One year later, in September 2008 when Lehman Brothers—the nation’s fourth-largest investment bank—filed for Chapter 11 bankruptcy, it signaled the start of the largest real estate crash of our lifetime.

It was like someone turned off Niagara Falls. One minute you are selling 10 homes a month, the next you have 20 listings and no buyers. The clients you just sold homes to start calling and saying that they could no longer afford their payments and had to sell—ASAP. Short sales and foreclosures quickly became the norm.

I was fortunate. Unlike the million-plus real estate licensees that left the business, I pivoted to working with distressed homeowners and became a Real Estate Owned (REO) agent. An REO agent represents banks and loan servicing companies to sell the homes that they foreclosed upon.

If you want to get ahead of any possible market shift, you can learn more about how I not only survived the recession, but how I thrived in a shifting real estate market in this course offered in The Close Pro.

In the meantime, here are a few more resources to help you prepare for a shifting market:

1. Diversify Your Lead Generation Strategies

As a rule, generating leads is going to be harder. That means you might have to change how you get leads.

37 Underrated Real Estate Lead Generation Ideas for 2022

2. Follow Industry Thought Leaders

Of course, watching and learning from industry thought leaders or top producers in your city can be helpful too. Chances are they have weathered recessions before, so look to see what they’re doing and how they change it up in response to the market.

2022 Will Make or Break Most Agents: Here’s How 10 Thought Leaders Are Preparing

3. Try Working With Investors

Contrary to popular belief, investors generally increase their buying activity when prices soften. If you want to get ahead of the game, learning how to work with investors can help.

9 Skills Agents Need to Work With Investors & Close 50-100 Deals a Year

4. Conquer Your Fear of Cold Calling

The days of business just falling in your lap might be coming to an end. The agents who thrive will be the agents who are fearless and relentless cold callers. Learn some tricks to get ready.

4 Real Estate Cold Calling Scripts + Tips to Conquer Your Fears

5. Keep Yourself Motivated

If you’re down in the dumps all the time, it’s going to be very hard to attract much new business. Learn how top agents bounce back, and copy their strategies so you stay fresh and confident no matter what happens in the market.

Real Estate Motivation: How Top Agents Bounce Back (Fast!)

Market Bubble History: What Houses & Tulips Have in Common

In the mid-1600s, tulips were imported from the Turkish Empire to Europe for the first time. They were so delicate and rare that the people of Holland saw them as a sign of great wealth and prestige. This made the already scarce but very fashionable tulip bulbs quickly rise in price.

The desire for this status symbol quickly spread throughout Europe. With millions of new buyers, a shortage of bulbs arose as growers could not keep up with demand. With limited supply and high demand, tulip sellers raised prices, then raised them again and again. The more the prices rose, the more the Dutch believed tulips were a wise investment. Sound familiar?

Eventually, the demand was so great that the Dutch set up a futures market to allow investors to buy and sell bulb contracts on end of season bulbs. The frenzy continued with premium tulip bulbs selling for over 5,000 florins, or $150,000 in today’s dollars!

That is, of course, until the bubonic plague reached Holland and kept bulb traders away from the crowded bulb auctions. Lack of trading caused prices to rapidly fall. Wanting to cash out, contract holders began to sell.

Tulip contracts then flooded the market and the more that were available, the lower the prices fell until values were below their previous “non-bubble” market value.

Citizens of Holland lost millions of dollars, leaving some in complete financial ruin. While Tulip Mania is the most famous bubble story, there’s a lesser-known bubble story you may not have heard of.

Lincoln’s National Debt: America’s First Real Estate Bubble

The first recorded real estate bubble in the newly formed United States was just after the Revolutionary War. The war caused some serious damage to the existing housing supply. After the war, much of the nation’s focus fell on rebuilding the infrastructure, but not rebuilding the housing supply.

By the early 1800s, life began to normalize and young families desired a home of their own. This caused housing values to rise quickly and helped spark the movement to homestead the west.

At this time, Abraham Lincoln was a young man living in Springfield, Illinois, and working as a land surveyor. Lincoln had inside knowledge that the railroad was planning to build tracks through his small town.

Believing that a railway would bring tourism and a bustling economy to his sleepy town, he borrowed money to buy the properties that would be directly across from the train station.

Lincoln wasn’t alone in his desire to get rich quickly from real estate. Property speculation was rampant across the country. Unregulated by the federal government, banks allowed for easy financing for properties and land. Real estate values skyrocketed as more and more people saw the opportunity to build wealth by speculating on real estate.

That is, until 1837. In an effort to prevent the banking system from collapsing, the federal government refused to allow banks to accept anything other than gold or silver for land purchases. This caused The Second Bank of the United States to foreclose on heavily mortgaged lands and farms. Does this sound familiar? A little like Lehman Brothers in 2007, right?

Values then began to rapidly fall as speculators sold off their lands before banks foreclosed on them—some for literally pennies! This caused “The Panic of 1837.” This recession put a temporary halt to western railway expansion and the tracks never came to Springfield. Lincoln’s dreams of being a wealthy real estate investor crumbled.

To make matters worse, when Lincoln couldn’t pay his debts, the properties were repossessed along with his survey equipment, cart, and donkey! Young Lincoln was left to repay his debt for the remainder of his life. As President, he would jokingly refer to it as the “National Debt.”

Past Housing Bubbles & Why They Popped

Like the tulip bubble, when housing bubbles burst it may not be just due to the buyers running out of money or getting scared out of the market, as you would think. Bubbles can burst due to unrelated events, like a plague or war.

Real estate bubbles were commonplace in the U.S. during the expansion to the west from 1821 through 1857. Land speculation was fueled by unregulated banking, agriculture (mainly cotton), and the Gold Rush, until this pattern was interrupted by the Civil War in 1861.

Large real estate speculation bubbles likely couldn’t occur for nearly 150 years due to four major wars and two depressions, leaving the U.S. economy and housing prices to mildly fluctuate with smaller booms and busts. Of the 50+ recessions and depressions that the country had seen, only three were caused by actual real estate bubbles.

Until 2008, when the country was on the tail end of an unprecedented 20-year economic boom that coincided with the introduction of subprime mortgages, creating a perfect environment for real estate speculation—and a massive housing bubble so large that when it burst, it disrupted the entire world’s economy.

The important point here is that while real estate bubbles are not a new occurrence, they are not very common, either. With the massive appreciation of the past two years, it feels like we may be in one now.

Over to You

Do you think your local market is approaching bubble territory and is ready to pop? Let us know your thoughts in the comments.